Lifetime mortgage lender Pure Retirement is bolstering its support to equity release advisers with the addition of new regional support to its intermediary sales team.

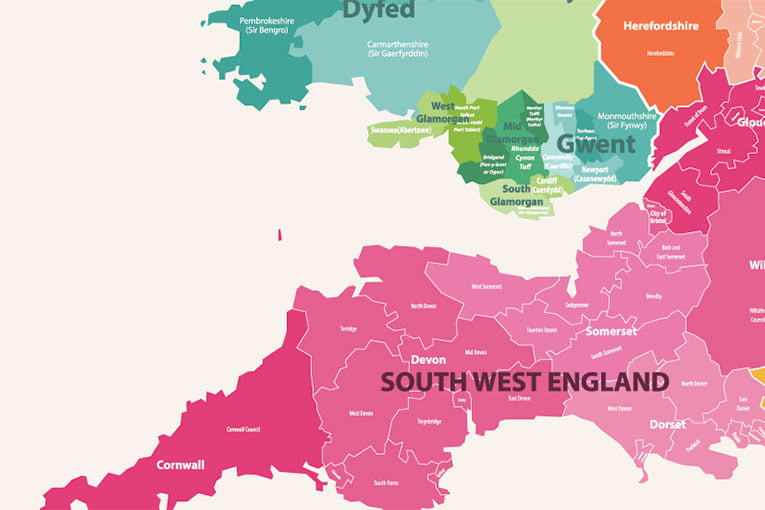

The lender has added Gemma Brown as a BDM, with her overseeing the South West & Wales regions. She has eight years’ experience in financial services, most recently as a mortgage and equity release broker.

This latest addition follows the recent appointment of Sam Owen as a telephone BDM, also for the South West & Wales regions. He comes with over seven years of financial services experiences across a variety of disciplines, including having been with Pure since 2022.

Scott Burman, Pure’s head of distribution, said: “The delivery of best outcomes for consumers begins with offering market-leading support, and we’re proud to be enhancing our regional intermediary sales offering to ensure that advisers get that assistance to help find the right solutions for their clients.

‘Our latest colleagues will bring a huge amount of insight and experience to the South West and Wales regions, working in partnership to provide advisers the best of both worlds through face-to-face and telephone BDM support, and we can’t wait to help our network going forward.”