A proptech startup aiming to modernise the UK’s home surveying process has reached its 1000th app download, six months after launch.

Survey Shack, developed by qualified surveyor Brett Ray, was introduced in October 2024 with the ambition of tackling one of the property market’s persistent pain points: transactions collapsing due to late-stage survey surprises.

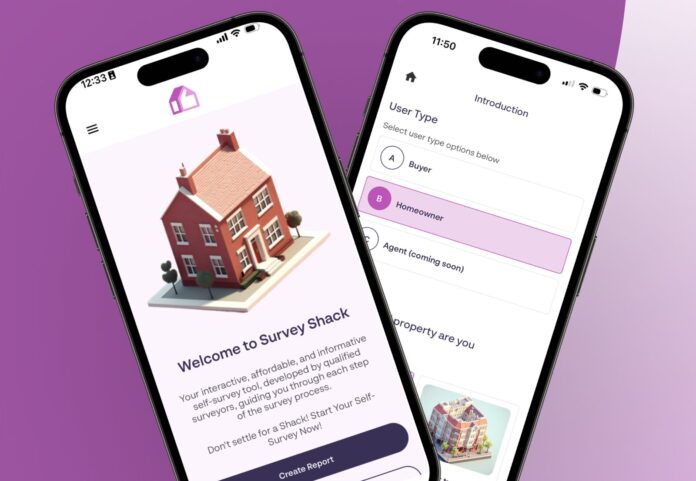

Designed to be used by both buyers and sellers, the app provides a digital toolkit for inspecting a property’s condition before a formal offer is made.

The aim, according to Ray, is to increase transparency and reduce the estimated 25% of property sales that fall through due to unforeseen issues flagged during conventional surveys.

FLIPPING THE TIMELINE

Ray, chief executive and founder of Survey Shack, says: “Too often, survey findings emerge at a point when both parties are emotionally and financially invested in the transaction.

“These aren’t unsellable homes – they’re homes where key details surfaced too late. We built Survey Shack to flip that timeline and give users the power to make informed decisions earlier in the process.”

The app’s core offering – a premium “Do It Yourself” (DIY) report – guides users through a structured property inspection via their smartphone. Once complete, the platform generates a detailed, interactive report with specific recommendations and, where appropriate, referrals to qualified professionals for further assessment.

DATA REPORT

A second component of the package, the Data Report, adds another layer of analysis, drawing on publicly available data sets to highlight local risks such as radon gas levels, surface water flooding, and planning histories.

For those looking to explore the service before committing, a free interactive tester provides a preview of the app’s functionality.

Since launch, user engagement has been balanced across the market, with 51% of downloads coming from prospective buyers and 49% from homeowners preparing to sell.