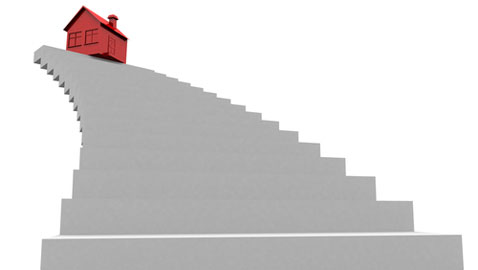

Brits are owning fewer homes over their lifetime than a generation ago, according to a new study from LV= home insurance.

The research reveals that rising house prices and stricter lending criteria has resulted in Brits making fewer moves up the property ladder. It’s estimated that today’s 20 and 30-somethings will own just 1.7 homes on average over their lifetime, compared to the over-50s who will own almost twice as many (3.2).

LV= said these findings echo official HMRC data showing that the number of property sales in the UK has fallen by a 21% since 2005, suggesting the downward trend is ongoing.

This means that today’s under-50s have much lower expectations of home ownership than their parents’. Most homeowners born after 1966 (i.e. aged under-50 today) believe they will own less homes over their lifetime than their parents did, while those born before 1966 believe they will own more. This partly due to people renting for longer as home ownership has become less attainable.

Renting rather than buying a property has become the only option for a large proportion of the population. 25% of Brits currently rent their home and have never owned a property, with most renters doing so because they are unable to buy. In total, 28% of renters want to move to a bigger house but can’t afford the deposit.

While many can’t get on the property ladder, there is a significant number who have ‘fallen off’. Almost 2.4 million adults have previously owned their own home but now live in rented accommodation. Some of these say they like the flexibility of renting (28%) but for many the reasons are financial, such as struggling to get a mortgage due to stricter lending rules (12%), not being able to afford a home in the area they want (11%) or struggling to afford the deposit they need (7%).

However, the decline in home ownership isn’t solely due to there being more renters. Around a third of homeowners (32%) want to move to a bigger property but are unable to, as house prices are so high. A fifth of homeowners (21%) can’t afford the deposit needed for a bigger home, and 16% are waiting for prices to drop before even contemplating a move. In fact, moving house has become so unattainable that many Brits believe they are already in their ‘forever’ home, including one in five people in their 30s (19%).

With so many people unable to move into a bigger property, some homeowners have tried to stretch the space in their home by partitioning a room, converting the loft into a living space, or even converting a basement or garage into a bedroom. Homeowners who have improved instead of moved say their building work cost an average of £9,000 to complete.

However, many families don’t realise that these modifications may contravene building regulations and could be unsafe. Among those who have carried out work, one in ten (10%) have no idea if the work complies with building regulations and just over on in 20 (6%) know for certain it doesn’t. Structural changes to a property need to be checked by the local authority and certificated as completed to a suitable standard. This could include knocking down internal walls and changes to how a space is used, e.g. from a garage to a bedroom. Homeowners also need to ensure they tell their insurer about any significant changes in their home as it may affect their cover.

Selwyn Fernandes, managing director of LV= home insurance, said: “While owning your own home was achievable for the previous generation, it is an impossible dream for many today. Rising house prices and strict lending criteria are not only preventing people from buying their own home but also stopping many homeowners from moving, forcing them to modify their homes.

“Building regulations are designed to ensure that home modifications are safe and we urge all those considering modifying their home to ensure any changes they are planning to make meet regulation standards.”