The number of overseas house hunters registering to buy property in Great Britain has fallen to its lowest level on record, driven by a sharp decline in European interest, according to new data from estate agency Hamptons.

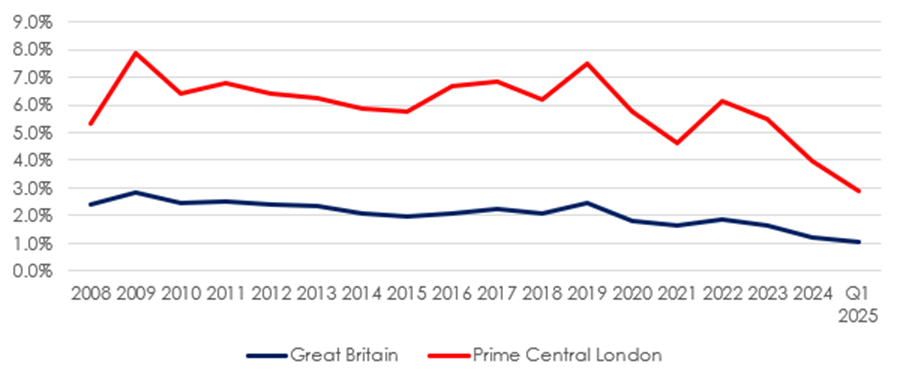

In the first quarter of 2025, just 1.0% of all property applicants were based overseas – a dramatic fall from 2.0% in 2015 and the lowest figure since Hamptons began tracking the data in 2008.

Source: Hamptons

The picture is especially stark in Prime Central London (PCL), long considered a magnet for foreign wealth, where international buyer share has dropped to 2.9%, down from a peak of 7.9% in 2009.

The primary cause of this decline, Hamptons says, is the waning appetite from European buyers.

BREXIT IMPACT

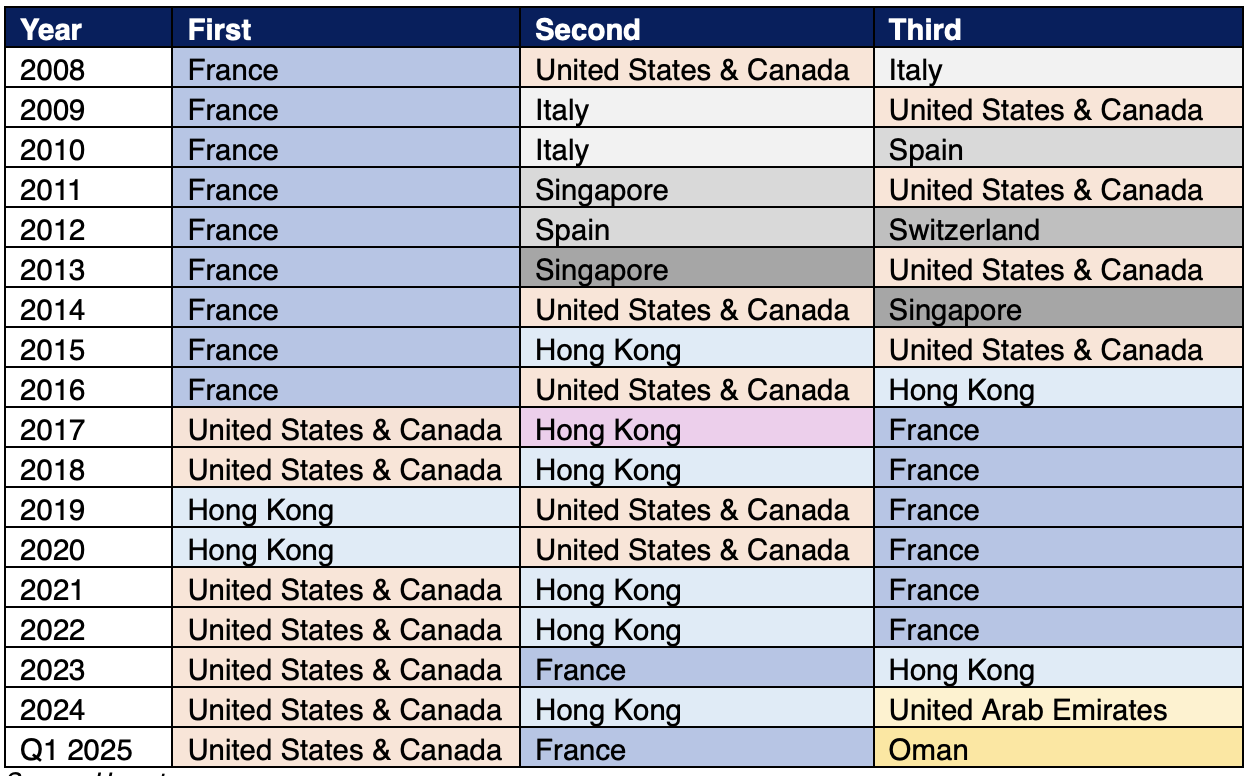

Once the dominant overseas group – accounting for nearly half (48%) of foreign house hunters in 2008 – Europeans now represent 43%, with drops in interest from countries such as France and Italy. These buyers historically moved to the UK for work, a trend disrupted by Brexit and exacerbated by the pandemic and changes to immigration rules.

Source: Hamptons

However, as European interest fades, new groups are stepping in.

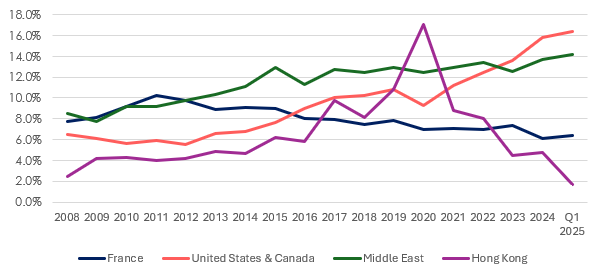

North American buyers, primarily from the United States and Canada, have more than doubled their share of international house hunter registrations since 2008 – rising from 6% to 16% in Q1 2025. Nearly three-quarters of these buyers are looking to make a permanent move to the UK, rather than purchasing second homes or investment properties.

Middle Eastern buyers have also increased their presence, accounting for 14% of all overseas applicants – a new high.

The majority (81%) of these buyers are seeking permanent relocation, reversing the previous trend of second-home purchases. In contrast, buyers from Hong Kong, who dominated international interest in 2020 following the launch of the BNO visa scheme, have fallen sharply to just 2% – the lowest on record.

Higher taxes and stricter regulations have played a critical role in reshaping international demand.

Source: Hamptons

The 2% stamp duty surcharge for overseas buyers, introduced in 2021, combined with October 2024’s hike in additional home purchase surcharges, means that a foreign buyer now pays over £113,000 in taxes when purchasing a £1 million second home in England.

This has led to a steep fall in demand for holiday homes and investment properties – now just 19% of international enquiries, down from 30% in 2019.

London remains the top destination for foreign buyers, with 54% still focused on the capital.

However, interest is spreading northward. One in 10 international applicants were searching for homes in the North of England in early 2025, double the level seen a decade ago.

Liverpool, in particular, is attracting overseas interest, accounting for 49% of international searches in the region.

Here, 66% of interest came from European buyers, many seeking affordable investment or relocation opportunities.

PLAYING POLITICS

Aneisha Beveridge, Head of Research at Hamptons, said: “Political events worldwide continue to influence demand for UK property from international buyers. But more recently, it’s tax changes that have stemmed the flow of overseas house hunters.

“Stamp duty increases, particularly for those purchasing second homes, combined with Brexit and amendments to the tax treatment of non-doms, have added to costs and reduced the lure of property in the UK.

“The case for buying a home, particularly in Prime Central London, has become increasingly tenuous for some international buyers.”

NO CAPITAL GROWTH

And she added: “For those immigrating for an undetermined period, the cost of buying property and the prospect of little or no capital growth, as seen over the last decade in PCL, have led many to opt for renting instead.

“That said, access to all the amenities and culture that London offers, combined with the country’s robust legal system, continues to attract money from overseas from those looking to buy.

“While Europeans used to be the driving force, with many relocating here for job purposes, Brexit has put a pause to that.

“ They have been increasingly replaced by Americans, spurred by the strength of the dollar and potentially influenced by political events at home.

“A home in the UK that would have cost someone buying in dollars £1m a decade ago, effectively costs them around £825,000 today due to currency changes alone. In most cases, this would offset the rise in stamp duty.”