The air under the arches of Waterloo Station smelled of old rain and fresh ink. London Money founder Martin Stewart adjusted the collar of his slightly wrinkled blazer, the one he usually reserved for client meetings – though today, the only signatures he was chasing were his own.

The folding table [wheely bin] in front of him wobbled slightly on the uneven pavement, weighed down by a neat stack of his debut novel, Goodbye Morecambe.

The title, in bold white letters against a brooding seascape, seemed to mirror the dark curve of the railway arch above him.

People bustled past – commuters, tourists, a few lost souls.

Now and then, someone would slow down, glance at the cover, then hurry on without a word.

Martin kept his smile steady, the same way he did when a mortgage deal fell through at the last minute – hopeful, but braced for disappointment.

Then, a young woman stopped.

She had a tote bag covered in literary quotes and the kind of curious eyes Martin had longed to see all morning.

“Goodbye Morecambe,” she read softly. “I’ve heard about this… you’re the author?”

Martin straightened. “Yes, I am,” he replied, perhaps too quickly. “Martin Stewart.”

The woman smiled and picked up a copy.

“I grew up near Morecambe. I always thought it was a place people arrived at, not left.”

“That’s what I used to think too,” Martin said. “Until I didn’t.”

He opened the book to the title page, pen poised. “Who shall I make it out to?”

“Leah, please.”

As Martin wrote, the rush of the trains above seemed to fade.

For a moment, he wasn’t just Martin Stewart, mortgage broker – he was Martin Stewart, author.

And beneath the arches of Waterloo, a small dream unfolded, one signature at a time.

AND BACK TO REALITY…

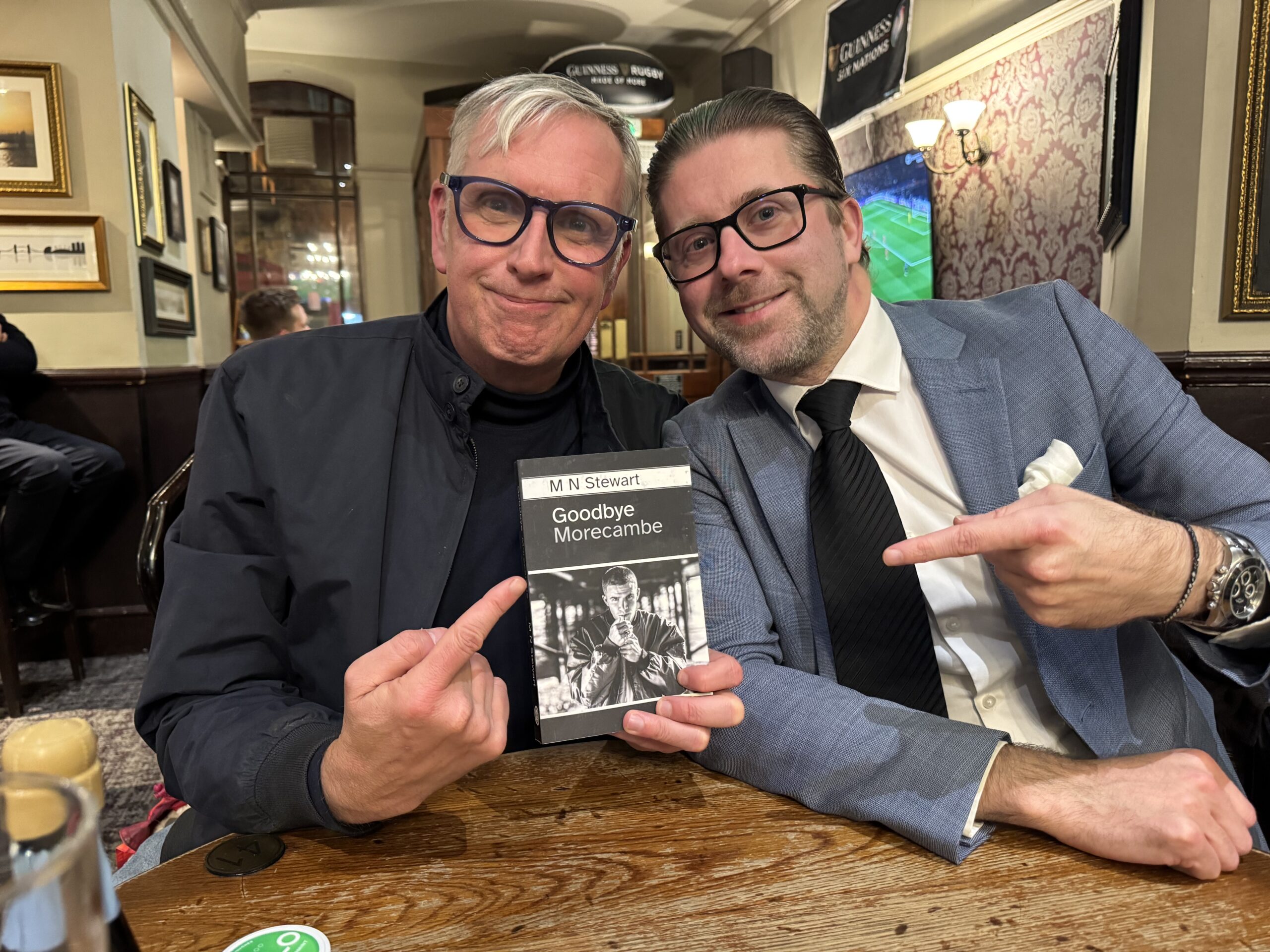

Here’s Mortgage Soup’s exclusive snaps of budding author and London Money founder Martin Stewart doing one of his many book signings – this time in London’s Waterloo.

As our snap show’s he’s having a ‘Wheely’ good time signing copies of the acclaimed Goodbye Morecambe for Brightstar top brass William Lloyd-Hayward (middle) and Movin’ Legal guru Emma Hall (left).

Not to be left out, United Trust Bank’s Frankie Kitchen was keen to join Stewart’s first London book signing too.

Kitchen told Mortgage Soup: “Martin is a leg-end – I would never have missed this event. I’ve already bought two copies of Goodbye Morecambe as gifts for my family and would urge anybody else looking for a bit of dark true romance to do the same. It’s a cracking read and one that I struggled to put down.”

Emma Hall, key relationship director at Movin’ Legal, added: “Goodbye Morecambe is one of the best books that I have read this year. It was truly gripping – I can’t wait to find out what happens next.”

And Lloyd-Hayward said: “Wow – what a book. Goodbye Morecambe was a book I couldn’t put idown!.”

Martin Stewart said: “Goodbye Morecambe is a love story – albeit one wrapped in barbed wire, held together by violence and tied off with a bow made of jealousy.”

Just like the mortgage market then…

Find out more HERE.