The UK mortgage market is showing signs of renewed momentum as 2026 gets underway with lenders cutting rates and credit availability improving, offering hope of stronger activity for brokers and training providers.

Several high‑street lenders have reduced mortgage pricing in early January as competition grows and funding costs ease, while the Bank of England’s Credit Conditions Survey shows increased availability of secured lending to households, with further gains expected in early 2026 despite subdued house purchase demand.

Analysts and industry commentators have flagged a potential rebound this year, describing prospects as broadly positive for mortgage lending and sales volumes following a challenging period of high rates and budget uncertainty.

GROWING DEMAND

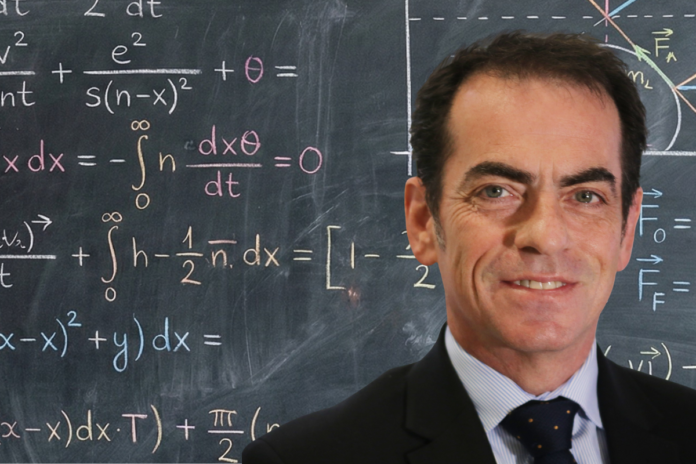

John Somerville (main picture, inset), director of financial services at the London Institute of Banking & Finance (LIBF), said: “The latest news on positive signs in the UK mortgage sector is incredibly welcome. It shows there’s never been a better time to do CeMAP, and demand has already been growing.

“Our message to firms is this: it’s now time to gear up so you’re ready to provide the best possible service to customers. If you’re not already training or recruiting new mortgage advisers, you might miss out, and it’s incredibly simple for people to get started.

“Learners can study and take their CeMAP exams remotely with LIBF, or you can find one of our accredited training partners to support you, wherever your firm is based.”