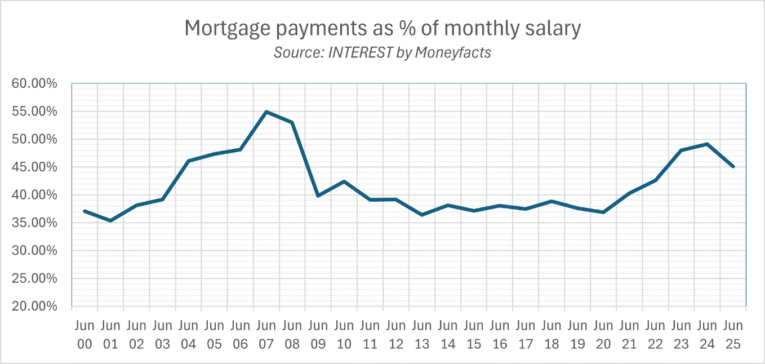

Monthly mortgage repayments are consuming a greater share of earnings than at any time since the 2008 financial crisis, according to fresh analysis from INTEREST by Moneyfacts.

The figures highlight how stretched household finances have become in the face of house prices that continue to outpace wage growth. An average earner taking on a new mortgage in recent years has seen close to half of their gross salary swallowed by monthly repayments.

At the turn of the millennium, the average UK home cost £78,000 – around five times the average wage of £15,800. By 2025, the average price had climbed to £269,000, around seven times the typical salary of £37,600, breaching conventional lending caps.

Since 2000, wages have risen by 237% while house prices have surged 345%.

Moneyfacts illustrated the disparity by comparing property inflation with everyday goods. If food prices had risen at the same pace as house prices, a loaf of bread would now cost £2.28 and a dozen eggs £4.73.

While rates have eased slightly from last year’s highs, affordability pressures remain acute. Borrowers able to access one of the lowest two-year fixed deals on the market – around 4.20% at 90% loan-to-value – could save roughly £100 a month compared with June’s average rate of 5.12%.

Even so, repayments would still absorb around 38% of gross monthly income, a level last seen in mid-2018.

FINANCIAL STRETCH

Adam French, head of news at Moneyfacts, said: “Affordability may have eased a touch over the past 12 months, but buying a home in 2025 is still too much of a financial stretch for many.

“Putting aside the not inconsiderable tasks of affording rapidly rising rent costs and saving a sizeable deposit, monthly mortgage repayments are eating up almost half of gross earnings – the toughest burden since the 2008 financial crisis.”

He added that the imbalance between prices and wages had been fuelled by years of ultra-low interest rates, government support schemes and restricted supply.

For many borrowers, the only way to reduce repayments to a more manageable 35% of income is to take out a mortgage over 50 years.

French warned that the market remained vulnerable to both an overcorrection and overheating depending on the course of interest rates, inflation and wage growth.

“We now need a period of stability where modest house price growth allows incomes to catch up so the market can return to more sustainable levels,” he said.

“In the meantime, it may mean holding rates where they are until inflation is in check is what is needed to nip another boom-and-bust cycle in the bud.”