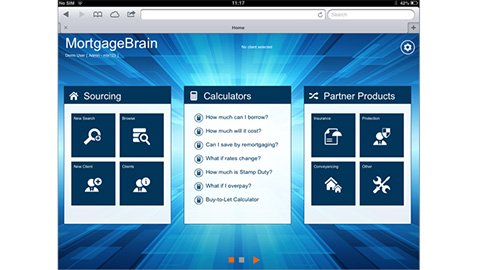

Mortgage Brain has announced the launch of MortgageBrain Anywhere, its online mortgage sourcing system.

The new online sourcing system covers the whole-of-market, and has been designed to be device independent. It can be accessed and conducted through a web browser on any device.

The firm says the system is optimised for PCs, Macs, the iPad and Android tablets, and can be controlled by touch or mouse.

Mark Lofthouse, CEO of Mortgage Brain, said: “MortgageBrain Anywhere is another huge stride forward for the UK mortgage market and we’re incredibly excited to be making it available to all with a full, industry-wide roll-out.

“The feedback we’ve received since the first announcements, at demonstrations, and throughout the pilot has been absolutely amazing. With MortgageBrain Anywhere brokers have the freedom and a new level of flexibility to source mortgages on any device or platform that is convenient.

“This means brokers can now provide new levels of service and interaction with their clients by conducting quick, yet thorough, whole-of-market mortgage searches and KFI production on any device or platform, and in any location.”