Mortgage Brain has widened its mobile technology offering with the launch of an iPad pre-sales mortgage app for brokers.

iSourceMortgages, which is free to download and try, is available now in the Apple Store.

Designed for use during the initial stage of the point-of-sale process, the app helps brokers to conduct a fast and comprehensive whole-of-market mortgage search and selection process for their clients.

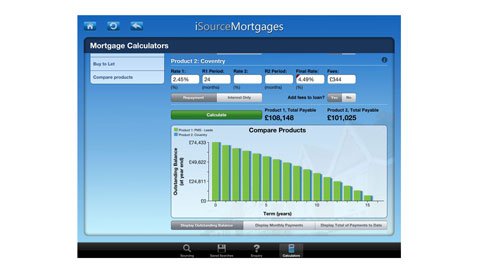

The app allows information on prospects to be collected as part of the advised sales process and features a number of mortgage calculators. Client details can also be transferred directly into the Key point-of-sale system, or retrieved from a lead capture portal.

iSourceMortgages is available for use by all mortgage brokers and IFAs and can be downloaded free of charge and used free for a trial period. A subscription of £10.00 + VAT per month applies thereafter.

Mark Lofthouse, CEO of Mortgage Brain, said: “In today’s rapidly changing market it’s more important than ever that mortgage brokers remain competitive and are in the best possible position to meet their customer’s needs, now and well into the future.

“The launch of iSourceMortgages is another example of our support, commitment and dedication to the UK mortgage broker market. Specifically created for the iPad, iSourceMortgages takes advantage of the latest available technology and is designed to enable intermediaries to professionally source the best mortgages available in the shortest possible time.”