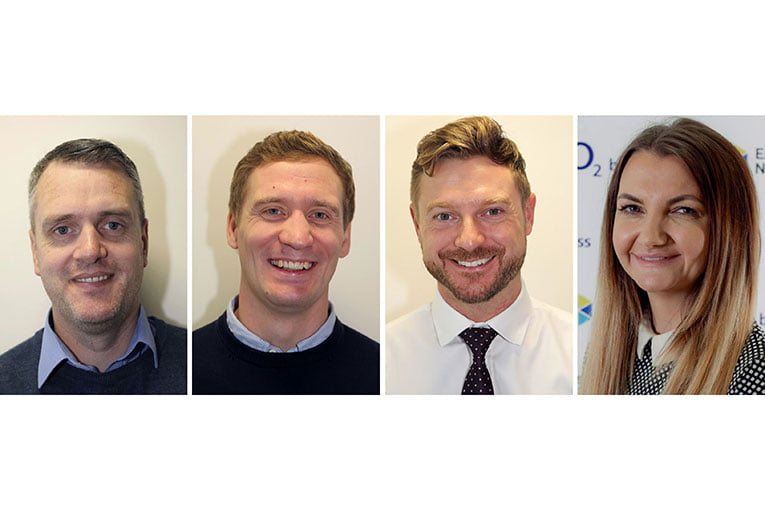

Mortgage Brain has finalised the appointment of four new national account managers.

Matt Surridge, a former business assurance manager at Countrywide, Geoff Webb, a mortgage software specialist who was responsible for intermediary systems development at IRESS, and Phil Daffern, previously a national key account manager at the Hinckley and Rugby Building Society, all joined Mortgage Brain towards the end of last year.

Gemma Lang, a business development manager at Kensington, completes the quartet having joined the national account management team early January.

She said: “Like Matt, Geoff and Phil, I’m very excited to be joining Mortgage Brain. Its record of achievement in the delivery of pioneering mortgage technology over the years speaks for itself and I am delighted to have the opportunity to play an important role in the continued development and growth of the business.”

Mark Lofthouse, CEO of Mortgage Brain, added: “I am delighted to welcome Matt, Geoff, Phil and Gemma to Mortgage Brain. The continued customer growth and development of our product portfolio continues to place us in a very strong position within the market and it’s imperative to have the right team in position to support both our business and customer needs.

“Our four new national account managers bring experience, expert skills and in-depth knowledge of the market, adding yet further strength and capability to our existing team.”