Households are curbing mortgage borrowing amid a cooling housing market, despite falling rates on new loans, while businesses are increasingly tapping banks for finance, according to the Bank of England’s latest Money and Credit data.

Net mortgage lending to individuals eased to £4.3 billion in August, down from £4.5 billion in July, continuing a gradual cooling of the housing finance market.

Gross lending slipped to £22.7 billion, from £24.5 billion a month earlier, while repayments edged up to £20.0 billion.

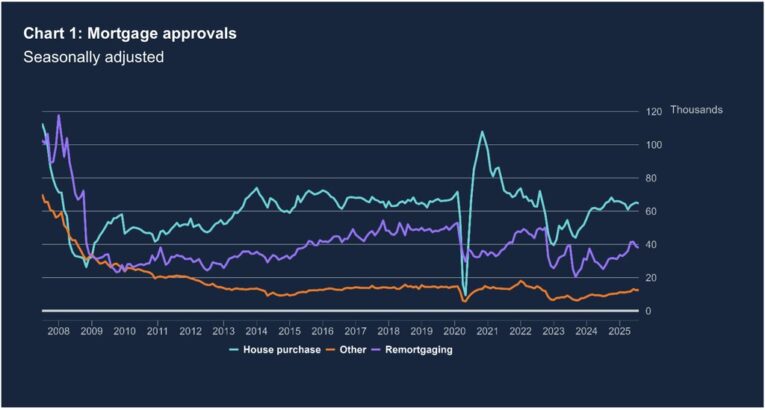

Mortgage approvals also softened: approvals for house purchases fell by 500 to 64,700, and remortgaging approvals declined by 900 to 37,900.

MIXED PICTURE

Despite this slowdown, the annual growth rate of net mortgage lending ticked up marginally from 2.9% to 3.0%. The effective interest rate on newly drawn mortgages fell for the sixth consecutive month, to 4.26% in August from 4.28% in July, offering some relief to borrowers. However, the average rate on the stock of outstanding mortgages nudged higher to 3.89%.

Consumer borrowing remained steady, with net consumer credit at £1.7 billion in August, unchanged from July. Credit card borrowing eased slightly to £0.7 billion, while other personal loans and car finance rose to £1.0 billion.

Annual growth in overall consumer credit edged up to 7.1%. The cost of unsecured borrowing remained high: overdraft rates increased to 21.53% and personal loan rates rose to 8.32%, though average credit card rates fell back to 21.42%.

CORPORATE FINANCE

But corporate demand for finance strengthened. Private non-financial corporations borrowed a net £5.9 billion in August, a sharp increase from £0.4 billion in July. The annual growth rate of borrowing by large businesses rose to 8.6%, while SME borrowing growth improved to 1.2%, its strongest pace since August 2021.

Deposits also grew, with the broad measure of sterling money (M4ex) rising by £10.9 billion, compared with £6.7 billion in July. Households contributed £5.4 billion of that increase, spreading funds across sight deposits, ISAs and current accounts, while corporates added £5.6 billion.

HOUSING MARKET PRESSURES

Ian Futcher, financial planner at Quilter, said: “The Bank of England’s latest Money and Credit figures highlight the continued pressures on the housing market.

“The residual effects of stamp duty changes, combined with ongoing affordability issues and the typical summer slowdown, are still dampening activity.

“Mortgage borrowing saw a sharp decline following the changes to stamp duty earlier this year, and it has been struggling since. Today’s figures show this trend has continued, as net borrowing of mortgage debt fell by £0.2 billion in August to £4.3 billion, following a £0.9 billion decrease to £4.5 billion in July.

“Approvals for house purchases – a key forward-looking measure – fell by 500 in August to 64,700, while remortgaging activity also continued to decline, with approvals dropping by 900 to 37,900.”

SUMMER SLOWDOWN

And he added: “Although a summer slowdown is typical, when combined with the other ongoing market pressures, including budget rumours, it could have wider implications for house prices.

“We are already seeing a dip in demand for homes over £500,000, for example. However, as we move further into the autumn and winter, the market will have had time to adjust to the stamp duty changes and more prospective buyers will have built up their savings enough to cover the higher tax bills, so we could see a gradual return of momentum.”

AFFORDABILITY CONCERNS

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: “With mortgage approvals falling only slightly in August, the underlying resilience of the housing market is in evidence despite many challenges facing it.

“The effective interest rate paid on new mortgages fell to 4.26% in August and since then, we have seen some lenders trim their mortgage rates further. However, with the rate on the outstanding stock of mortgages increasing slightly to 3.89%, affordability remains a concern for many.

“Remortgaging numbers have also dropped, suggesting that borrowers may be sticking with their existing lender and refinancing rather than going through the hassle of another mortgage application with a new lender.”

STEADY MARKET

Simon Gammon, managing partner, Knight Frank Finance, said: “The mortgage market remains remarkably steady.

“Net approvals for house purchases have moved by fewer than 1,000 month-on-month for the past three months, with August’s figure dipping only slightly to 64,700. Lending rates have also held firm since the last Bank of England decision, reinforcing a broader picture of stability – activity is consistent, and borrowers have largely adjusted to the current rate environment.

“We’re beginning to see a touch of hesitation ahead of the Budget.”

“That said, at the top end we’re beginning to see a touch of hesitation ahead of the Budget. Some high-value buyers are choosing to wait for greater clarity around potential tax changes before completing transactions, which could make the coming months quieter for those discretionary purchases.”

WAIT AND SEE APPROACH

Tomer Aboody, director of specialist lender MT Finance, says: “The ongoing uncertainty with regard to the upcoming Budget is inevitably resulting in buyers and sellers adopting a ‘wait and see’ approach.

“Despite cheaper borrowing rates, transactional levels remain stunted.

“This further underlines the case for the Chancellor taking action to reduce or reform stamp duty in order to allow the market to really start to function effectively, which in turn will help strengthen the wider economy.”

STRONG BUYER DEMAND

Stephanie Daley, director of partnerships at Alexander Hall, said: “While mortgage approvals have dipped slightly on a monthly basis this is almost certainly down to summer seasonality and the broader picture remains one of resilience, with activity consistently holding above the 60,000 threshold for well over a year.

“This level of consistency highlights that underlying buyer demand is strong, and recent incentives, such as the decision to make the Mortgage Guarantee Scheme permanent and adjustments to loan-to-income caps, are helping to improve accessibility and affordability across the market.

“Major lenders have already started to respond with more flexible criteria.”

“At the same time, major lenders have already started to respond with more flexible criteria, enabling more buyers to secure the finance they need.

“Looking ahead, the outlook for the remainder of the year remains positive, and we expect these supportive measures to underpin continued buyer activity.”

LANDLORD OPPORTUNITIES

Emma Cox, MD of Real Estate at Shawbrook, said: “Following a increase in July, August has had a surprise dip as concerns surrounding affordability stifle growth.

“As the economic environment remains challenging and with minimal movement in house prices, buyers and professional landlords will be hoping that a more stable interest rate environment will lead to more favourable deals entering the market.

“Professional landlords will be reassured by a stable market.”

“Despite the slight dip in approvals, professional landlords will be reassured by a stable market and continued strong tenant demand which has given many investors the confidence to continue.

“This opens up further opportunities for landlords to capitalise, expand their portfolios, maximise yields and grow their businesses.”

FALL-THROUGHS INCREASING

Jonathan Samuels, CEO of Octane Capital, said: “A marginal month-on-month dip in approval numbers suggests that buyer appetites remain robust, however, the challenge facing the market at present isn’t a lack of intent on the side of homebuyers, but this intent translating into action.

“We’re simply not seeing buyers commit which has led to a surplus of stock and, as a result, sellers are finding transaction timelines increasingly lengthy and fraught with potential pitfalls.

“This has driven an increase in fall-throughs.”

“This has driven an increase in fall-throughs, with many buyers and sellers seeing chains collapse at the eleventh hour.

“In these circumstances, we’ve seen a growing number of residential sellers turn to the specialist finance sector to secure bridging loans, helping them to protect their onward purchase and keep transactions on track.”

ECONOMIC UNCERTAINTY

Richard Donnell, Executive Director at Zoopla, added: “The demand for mortgages cooled in August with 500 fewer approvals for mortgages to buy homes, down to 64,700.

“It appears that higher borrowing costs and broader economic uncertainty are prompting a pause for reflection among homebuyers.

“Demand for homes at the upper end of the market is already being hit ahead of the Budget as speculation grows over possible changes to the taxation of high value homes.”