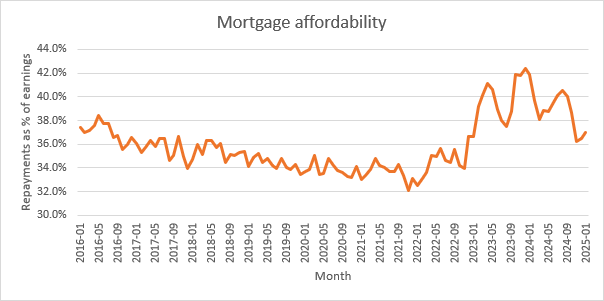

January saw a weakening in mortgage affordability weakened for the second month in a row, according to new analysis from Stonebridge.

The mortgage and protection network’s latest bi-monthly Mortgage Affordability Index reveals that borrowers spent more of their salary on monthly repayments in both December and January than in previous months.

In December, mortgage repayments accounted for 36.5% of the average borrower’s salary, up from 36.3% in November. This figure increased again to 37% in January, meaning affordability has deteriorated for the second month running.

The decline in affordability is largely down to the combination of increasing loan sizes, slow wage growth and rising mortgage rates.

Stonebridge’s data shows the average loan size grew 1.4% to £192,114 in January, while the average annual salary ticked up 0.5% between December and January, according to the Office for National Statistics.

The average rate on new mortgages increased for the first time in five months, rising 4 basis points to 4.51%, according to loan data from the Bank of England.

However, affordability is still significantly better than it was in December 2023, when mortgage repayments accounted for 42.4% of the average salary. The long-running average is 35.9%.

Stonebridge’s Mortgage Affordability Index combines official wage and mortgage rate statistics with its own loan data to determine the relative affordability of mortgage finance in proportion to the average borrower’s earnings.

Rob Clifford, chief executive at Stonebridge, said: “Mortgage affordability has continued to be tight for the second consecutive month as rising house prices push loan sizes higher and mortgage rates edged up. But in context, remember that affordability remains significantly better than at the start of last year, and affordability will definitely improve as rates fall in coming months.

“While the Bank of England’s Monetary Policy Committee opted to hold rates in May, there are mounting calls for it to reduce borrowing costs further.

“Inflation remains a concern, but much of the recent increase is imported, driven by rising energy costs and a strong dollar rather than by surging domestic demand. As a result, the risk of inflation spiralling out of control again appears limited.

“At the same time, the UK economy is struggling for momentum. If growth continues to stall, the MPC may have little choice but to step in to provide support. That could lead to lower borrowing costs in the months ahead, offering much-needed relief to mortgage borrowers, who are still grappling with the impact of the cost-of-living crisis.”