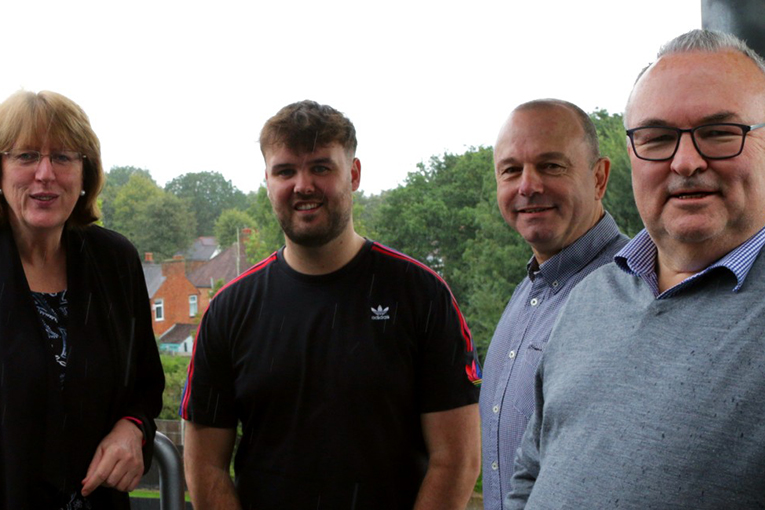

Short-term lender Signature Property Finance has announced a series of new appointments, as it creates new roles and expands the existing relationship management team, to help meet rising demand from property developers and landlords.

Experienced property finance Consultant Huw Richards, joins the team based in Signature’s Cardiff office, along with Ken Davies, a specialist in development finance, who has been appointed to increase this already burgeoning aspect of the lender’s business.

Bernadette Moloney is the firm’s new business development executive, who brings more than 20 years’ experience of design and architecture practises to her role, focussed on building relationships with prospective broker clients across the country.

The final appointment for Signature sees client relationship executive Josh Barrett, also join the Cardiff based team. As a member of the lending team, he helps progress deals, undertakes searches and manages electronic documentation to support loan applications.

Signature Sales Director Paul Tromans said: “Given all the problems the market and wider economy has faced in the last 18 months, it’s good to report Signature is performing well and the increasing number of enquires has required this recent recruitment drive.

“As a renowned property finance consultant, Huw brings a great deal of experience to our business and will help us increase the deals we support in Wales and across the South West. These are good regions for Signature, but we know there are brokers still seeking the sort of high-quality, transparent service we provide, with no nasty sting in the tail.

“Bringing Ken on board has strengthened our development finance offering, which has already proved a success for Signature, in the small-scale new build space. Ken is straight-talker, with hands-on property development experience, which really allows him to understand the potential in a project and make informed lending decisions.

“Bernadette is helping us reach more brokers than our 7-strong team of relationship managers can manage, raising awareness of our brand, what it stands for and how we conduct our business – client centric, transparent and always doing what we say we will do.

“Josh is not just the future of Signature, but the property finance industry as a whole. He is a bright, talented individual, who has made Cardiff his home after studying at University there and graduating with a degree in Business & Management (Finance). We’re confident Signature will provide the relevant practical experience he now needs to round out his learning in the property finance sector.

“Signature is building a team that matches the firm’s ambition. With our new products, consistent service quality and determination to deliver what brokers and their clients need, we see a bright future for our unique overall approach to short-term property finance, which few can match and none can beat.”