More 2 Life has launched a new enhanced Loan To Value (LTV) calculator for advisers.

It is the third new calculator launched by the equity release lender in the last five months.

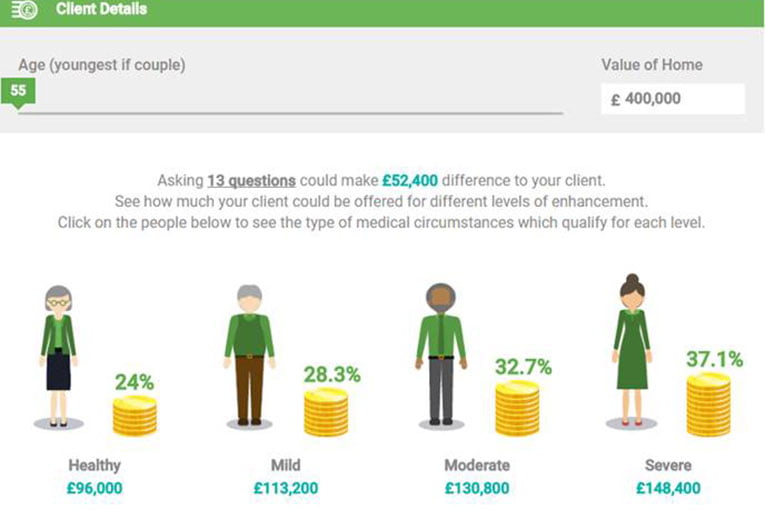

This new tool will allow advisers to show a client an interactive representation of how much extra finance they could qualify for with an enhanced plan at different levels of enhancement. It will also show examples of the types of medical circumstances clients could qualify for within each ‘level’ of enhancement, updating dynamic graphics as the values are changed.

Stuart Wilson, corporate marketing director at More 2 Life said: “Our new enhanced LTV calculator is a useful tool in assisting advisers with calculating how much clients can qualify for with an enhanced plan.

“This is the final tool from the trio of calculators launched within the last five months which aims to help advisers as we continue to grow and develop new innovative ways to support advisers into 2019. We continue to strive to be the sector innovator in technological advances to assist both advisers and clients.

“By launching this calculator so early into the year we hope advisers will be able to utilise the new tools as they work towards a successful 2019.”

The Enhanced LTV Calculator is located on the More 2 Life adviser website under the ‘Tools to help you’ tab.