MCI Mortgage Club has appointed Mamie Bradshaw as its new business development manager (BDM).

The club was launched late 2014 and currently has 19 lenders on its panel.

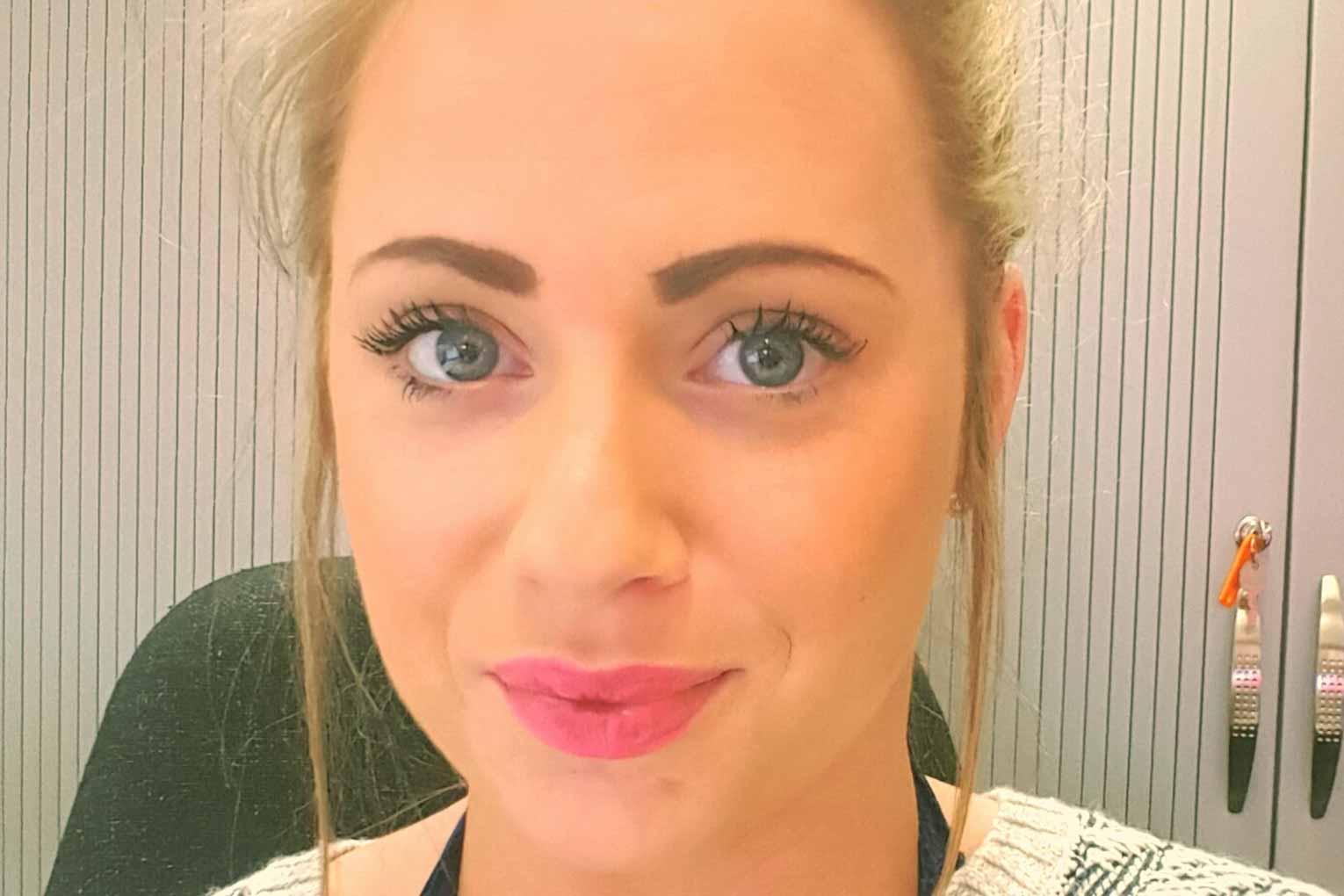

Bradshaw (pictured) has experience in sales and marketing as well as events management. She will be responsible for the club’s planned corporate events programme as well as managing MCI’s social media activity.

Phil Whitehouse, managing director, of MCI Mortgage Club, said: “At a time of some general market uncertainty I am delighted to welcome Mamie on board at MCI Club as our first field based business development manager.

“In such a short time, Mamie has already proven she will be a major asset for MCI Club this year as she forges even stronger face to face relationships with our top intermediary customers.

“MCI Club not only offers a mortgage club facility with access to a wide panel of lenders and insurers, but importantly technology support through its parent company, Mortgagekeeper, part of the EKeeper Group of companies.

“Mamie will be predominantly visiting intermediary firms that are already associated with the eKeeper Group and working closely with them to not only help them to sell more products but to do so in an effective manner therefore saving MCI Customers precious time.”

Bradshaw added: “To me building relationships with our intermediary partners is most important. I’m very much looking forward to meeting with brokers, listening to their needs and offering any tools and assistance we can to make their day to day job easier.”

Whitehouse said he expects to see significant growth this year and expects to further recruit over the coming months.”