Borro has reported a rising trend in individuals and business owners using high-value and unusual timepieces as collateral for loans.

The personal asset lender has seen a wide range of watches come into its vaults. A Patek Philippe Split Seconds Chronograph wristwatch achieved a loan value of £105,000 for example, while another client secured a £100,000 loan using a Hublot Key of Time watch as collateral.

The borro vaults have also seen a Cartier Ballon Bleu 18k White Gold wristwatch, and a Concord C1 Tourbillon Gravity Titanium limited edition gentleman’s wristwatch; both models secured a loan value of £50,000.

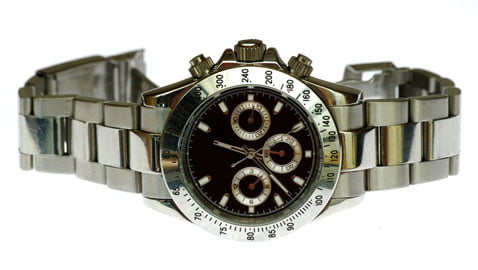

Since launch in 2008 borro has loaned clients almost £10 million within this asset class. Over the last 12 months, the fastest growing brand of watch being seen in the borro vaults is the Hublot, followed by Bulgari timepieces and then models from Concord. However, since launch the most popular brand of watch used as collateral for loans by borro’s clients is the Rolex:

Top 10 watch brands used by borro clients:

1. Rolex

2. Cartier

3. Patek Philippe

4. Breitling

5. Audemars Piguet

6. Omega

7. Panerai

8. Tag Heuer

9. Jaeger-LeCoultre

10. Hublot

Samantha Lilley, head of valuation at borro, says: “Wristwatches started to become more commonplace after the First World War when officers would convert their pocket watches to something that could be worn on the wrist, which was more practical during combat situations.

“The vast growth in the popularity of wearing watches led to their specific manufacture from the late 1910s into the 1920s and 1930s onwards – arguably the beginning of some of the best and enduring designs that have evolved into the more familiar models that we recognise today.”

Paul Aitken, CEO and founder of borro, added: “Following buying sprees of the boom years, individuals have built up a wealth of assets, including watches, as investment pieces, and now many are turning to these unusual assets to access liquidity. Against the current economic background, we are seeing clients looking for savvy ways of raising money to perhaps realise business opportunities, or to pay for unexpected financial situations.

“Unlocking the value of unique personal assets provides a solution that doesn’t involve permanently parting with valuables that may also be family heirlooms with a great deal of sentimentality attached. Borrowing against personal assets is a fast alternative to equity release from property, and also doesn’t require any credit checks.”