Legal & General paid 2,949 group protection claims worth a total of £264m in 2016 and 12% more than in 2015.

Overall, the insurer paid 97% of group protection claims received and at an average rate equivalent to £5.1m a week.

There were increases in the benefits paid across all products. Legal & General paid 99% of group life claims in 2016 and a total of £234m was paid to 1,964 claimants, up 10% on 2015’s figure of £213m.

The insurer paid 81% of group critical illness claims in 2016, up from 76% in 2015. Over £10m was paid to 147 claimants, a 30% increase on 2015’s figure of £7.9m.

Legal & General paid 95% of new group income protection claims in 2016. This represents an annual benefit of £20m being paid to 838 claimants, and an increase on 2015’s figure of £14m.

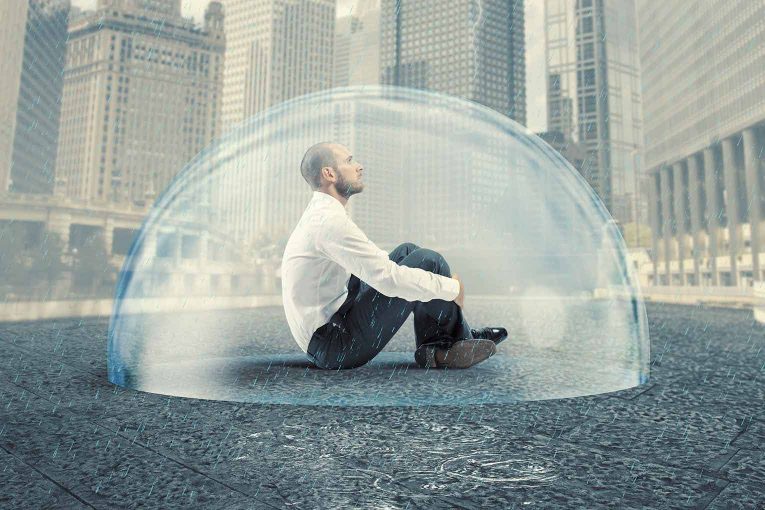

Mental health issues have been the top cause of claims on Legal & General’s group income protection policies since 1999 and accounted for 33% of new claims in 2016, up from 30% in 2015.

Vanessa Sallows, benefits and governance director at Legal & General’s group protection, said: “We strive to pay as many valid claims as quickly as possible and these figures highlight the fundamental role we play within the group protection industry. Paying 97% of claims received and a weekly average of £5.1m is real evidence of the how these policies can provide valuable financial support to our customers and their employees when they need it most.

“Mental health continues to be the main reason for absences on our group income protection. We know that earlier treatment makes an earlier return to work more likely so it’s thrilling to see over a third of people taking advantage of the flexibility provided by our new digital mental health treatments.

“Furthermore, Legal & General will soon be launching a major initiative to encourage more conversations in the workplace about mental health; we should talk about mental health as freely as we discuss physical health.”