The partnership between online mortgage lender LendInvest and LOT11 has now gone live.

The arrangement sees LendInvest pre-qualify lots at LOT11 auctions which fall within the lender’s criteria.

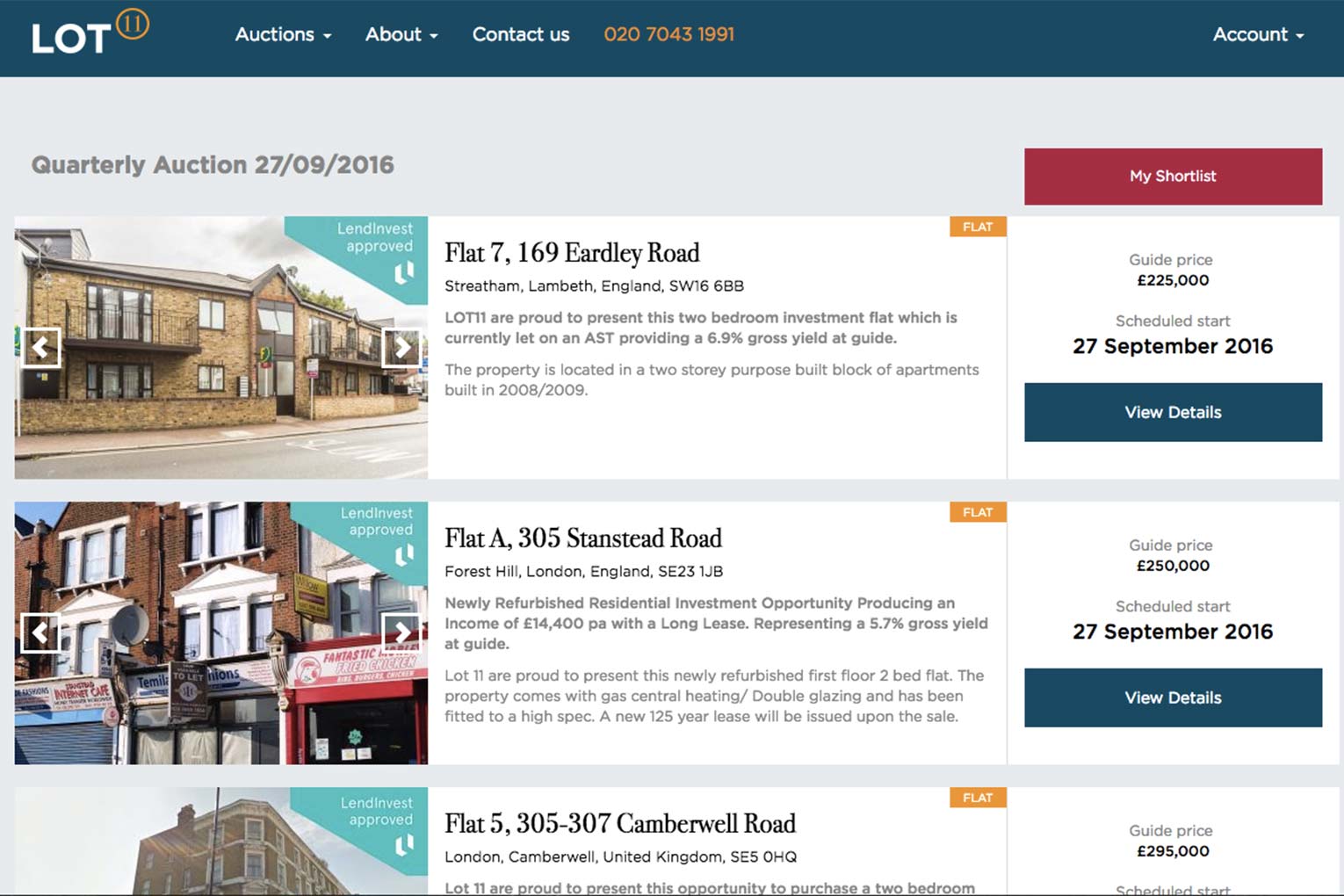

LendInvest’s logo appears alongside the auction properties that it has pre-qualified, ensuring bidders and their brokers can see which properties LendInvest is prepared to lend against.

LOT11 is an online auction house, offering properties for auction on a weekly and quarterly basis. It held its first auction in November 2015, and has sold properties across the asset classes throughout the UK.

Matthew Tooth, head of distribution at LendInvest, said: “Online auctions are an excellent option for investors looking to secure a good price on their next investment property. This partnership has been designed to ensure prospective buyers and their brokers can move quickly to secure finance on any property that catches their eye.”