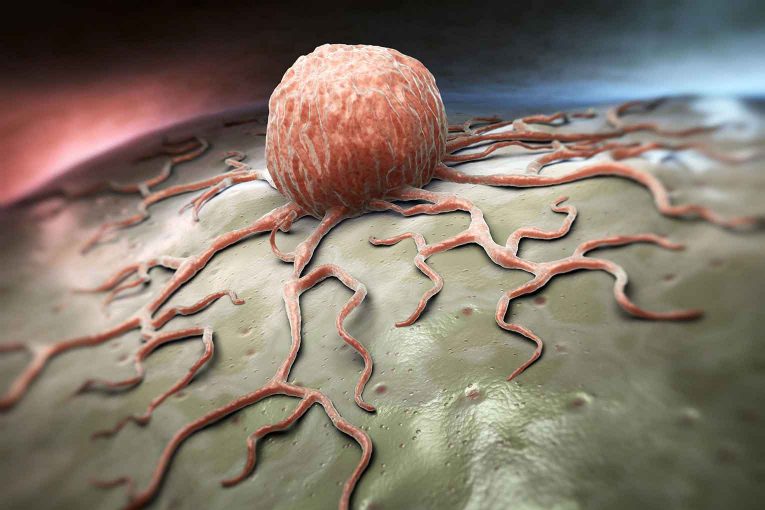

Legal & General Group Protection has updated its Group critical illness cover (CIC) definitions for cancer, heart attack and dementia, in a move designed to help provide improved clarity to its customers and their insured employees.

In the case of the cancer definition, the changes also allow greater scope in the type of cancer claims that can be made.

Legal & General’s changes include:

- Cancer: Early-stage prostate cancers – the revised wording allows tumours classified as below Gleason score 7 to be included if they have undergone treatment by prostatectomy.

- Dementia: Previously, Alzheimer’s and pre-senile dementia appeared as separate definitions. However, the new definition combines Alzheimer’s with all other forms of dementia. This will provide greater clarity to customers around a dementia diagnosis and what is covered

- Heart attack: The evidence required for a definite diagnosis of heart attack has now been extended to include ‘typical clinical symptoms (for example, characteristic chest pain)’ These changes reflect the latest medical diagnostic techniques used to diagnose this condition and help provide clear expectations of the scope and limitations of what we cover.

James Walker, head of product and proposition, Legal & General Group Protection, said: “These latest changes aim to help ensure simplicity, reducing any confusion amongst intermediaries, business customers and insured employees alike.

“The cancer wording changes may also result in providing greater certainty, when it comes to claims, helping give reassurance at a vulnerable time whilst boosting confidence in the value of CIC. That said, we’re already seeing this product becoming more important to customers.

“After seeing group CIC claims almost double in 2021 to £13.2m (from £7.2m in 2020), our latest results announced earlier this year revealed another increase in 2022 to £18m.”