With Trump’s tariff wars already sending financial markets yoyoing up and down and the likelihood that these trade wars will negatively impact both global and local economies, including the UK, at some point, this is likely to affect the mortgage market, too.

As evidence of this, it’s only a short time ago that we experienced something which on the surface appears to be a very similar shock that drove mortgage rates upwards.

This was when Liz Truss came to office and produced a budget that led to a lack of confidence in the UK government and its finances.

This, along with a rise in inflation, led to a rise in bank base rates rising rapidly, which in turn sent mortgage rates from an average of 4% before she took office to 5, 6% or more, within a matter of months.

Lessons from the Past: Why Higher Mortgage Rates Didn’t Crash the UK Property Market

However, this doesn’t mean from a property perspective, rises in mortgage rates will always negatively impact the market.

One of the most interesting things about this rapid rise in mortgage rates was that in the past, it would have caused the property market to crash – as it did when money to lend dried up in 2008 – but, although property prices fell by an average of 5% post the large mortgage rate rises (bar the Prime property market), they certainly didn’t crash.

Here’s why:

- More mortgage-free homeowners: Since the 2008 financial crisis, more people now own their homes outright, making them less vulnerable to rate hikes.

- Stronger equity positions: Post-2014, first-time buyers typically took out repayment rather than interest-only mortgages, boosting equity buffers.

- Stricter affordability tests: Lenders began stress-testing mortgages at rates of 6-7%, meaning many first time buyers from 2014 could survive rate increases.

- High cash buyer presence: Zoopla data reveals that around 50% of buyers either pay in cash or use low LTV mortgages (<50%).

- Government intervention: Policy support—seen during the 2008 crash, COVID-19, and recent cost-of-living crises has helped keep repossessions low, which stabilises prices.

So the question now is, after all of these changes, how will the latest economic shock affect the mortgage market?

So what does this mean for Mortgage Rates in 2025?

So far, Trumps tariff war has had a positive impact on mortgage rates in the UK as according to the BBC “ A growing number of UK lenders are cutting mortgage rates as the fall out from US tariffs continues to fuel forecasts of deeper than expected interest rate cuts.”

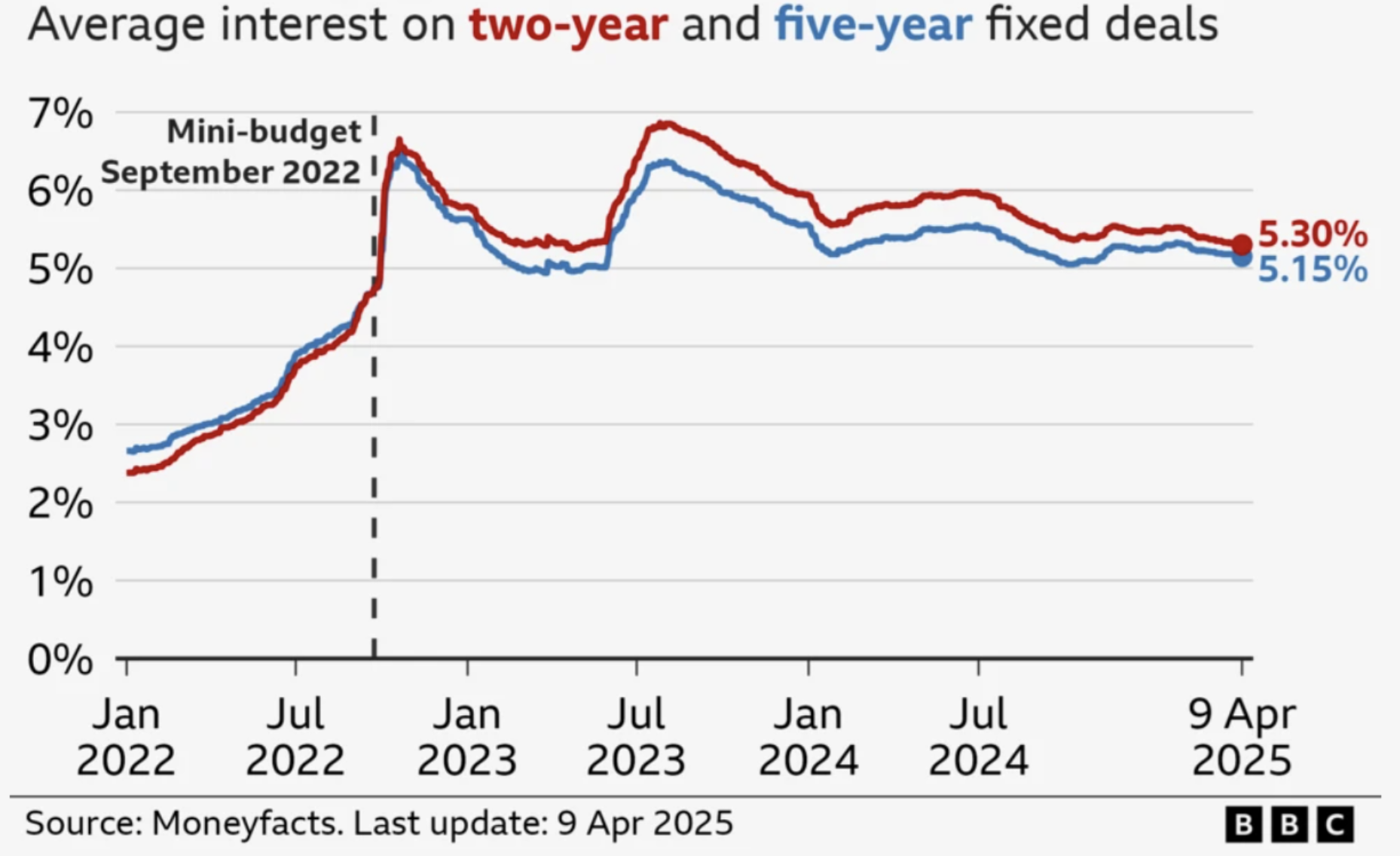

The chart below from Moneyfacts and the BBC shows ‘average’ two and five year fixed rate deals have already fallen to their lowest rates since July 2023.

Although these rates still seem high since the Credit Crunch, prior to 2008, average mortgage rates hovered between 5 and 7%, so historically we are already back to normal rates.

However, the good news is that for those with decent deposits, rates are much lower now than this average and have even dipped below the 4% – which we haven’t seen since 2022.

According to Capital Economics – which has a great track record of forecasting bank base rates – “UK inflation and interest rates [are likely to] fall quicker than we previously anticipated.”

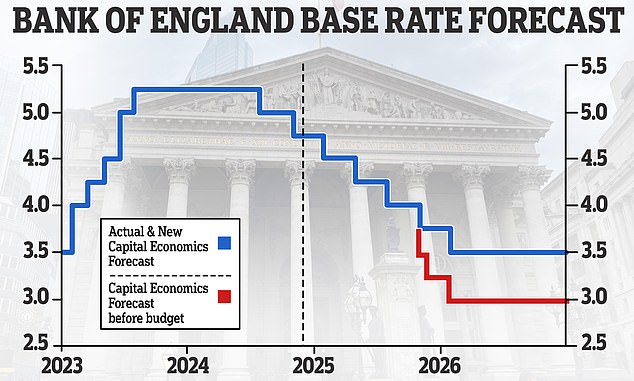

The reason mortgage rates are coming down is that the markets are now suggesting that base rates will fall from their current rate of 4.5% to 3.75% with four cuts now priced in versus the three prior to Trump announcing huge rises in tariffs, especially on Chinese imports.

And as you can see from the Daily Mail’s chart below, forecasts from Capital Economics suggest they could fall as low as 3.5% in 2026.

What are the implications for Buy-to-Let mortgages in 2025?

So what do the experts have to say? National Landlord Investment Show asked Gavin Richardson, MD from MFB Mortgage Finance Brokers for his key insights about the impact of Trump’s tariffs on mortgage rates and addresses the key question, fix now or wait it out when it comes to mortgages. Read the full commentary HERE.

With all these external and internal factors at play when it comes to the UK property market, staying informed and networked is key to success for property investors.

Attending events like The National Landlord Investment Show offers investors and property professionals a platform to connect, network and stay informed on critical topics affecting the buy-to-let and private rented sector (PRS).

Kate Faulkner OBE is a UK property analyst and founder of Property Checklists. This article was first published by National Landlord Investment Show.