British households are borrowing more – and lenders are increasingly willing to let them – but the cost of unsecured credit is rising even as mortgage spreads narrow, latest data from the Bank of England’s latest Credit Conditions Survey reveals.

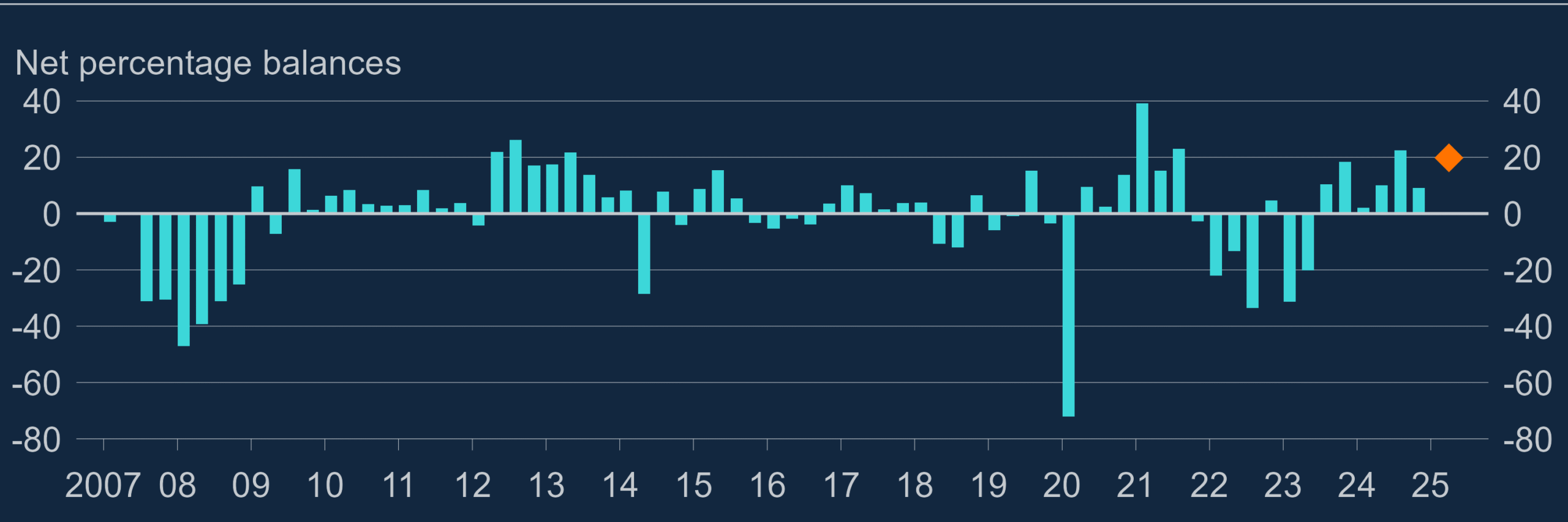

The availability of both secured and unsecured lending to households improved in the first quarter of 2025 and is expected to rise further in the coming months.

Lenders reported a modest increase in mortgage availability through to the end of February and forecast further easing into May.

Access to unsecured credit, including credit cards and personal loans, also rose and is on track to climb again in Q2.

The rise in secured credit supply comes amid an uptick in borrower demand. Mortgage applications for house purchases rose in Q1, driven by improved affordability and competitive rate offerings. However, demand is expected to level off in Q2.

Source: Bank of England

Meanwhile remortgaging activity is picking up steam, with lenders expecting continued growth as homeowners seek to lock in deals ahead of any potential interest rate movements.

Unsecured lending is also seeing renewed momentum. Demand for credit cards rose in Q1 and is projected to continue its upward trend, while personal loan demand is expected to rebound after a flat quarter.

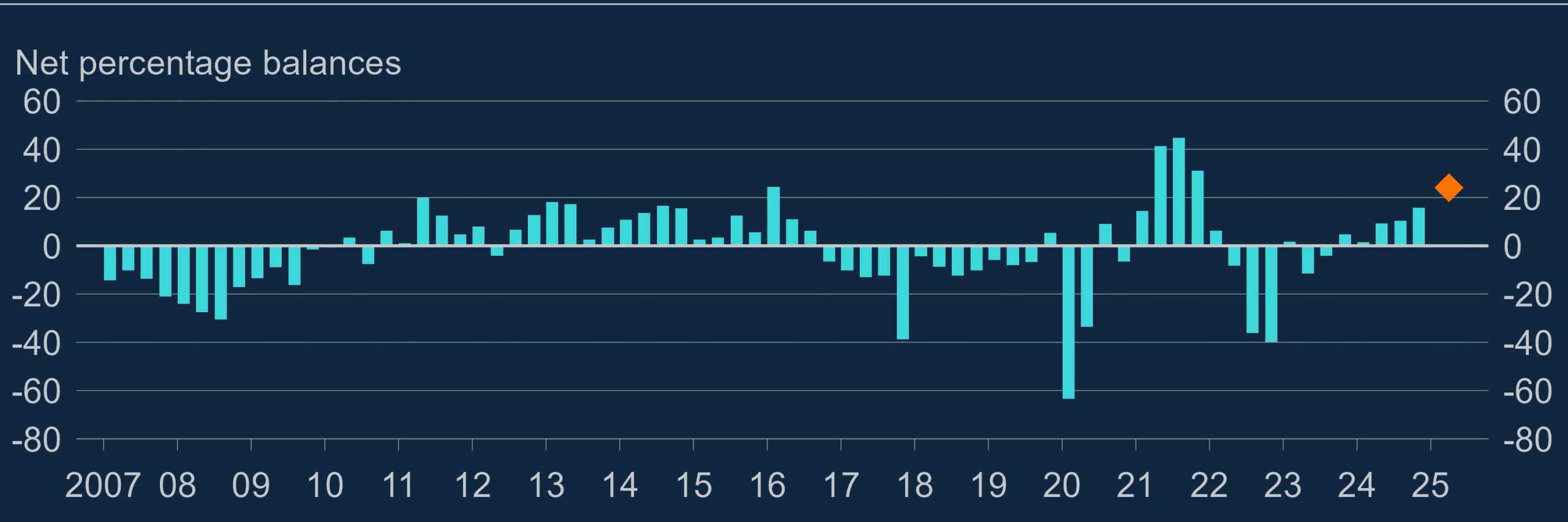

Source: Bank of England

The surge in credit appetite comes as households face ongoing cost-of-living pressures, even as inflation trends lower.

But while spreads on secured lending narrowed in Q1 and are expected to remain stable, the cost of unsecured borrowing is moving in the opposite direction.

Spreads on unsecured credit widened in the first quarter and are forecast to widen further into Q2, reflecting lenders’ cautious approach to risk amid a mixed economic outlook.

On the risk front, lenders reported no change in default rates for mortgages in Q1, although losses when borrowers default did edge higher.

Meanwhile, unsecured loan defaults declined, particularly on credit cards, where the drop was most pronounced. Defaults are expected to stabilise in Q2.

COMPETITION HAS GROWN

Simon Gammon, managing partner at Knight Frank Finance, said: “Mortgage availability is set to improve markedly through to the end of May, according to the Bank of England’s latest survey of lenders. These responses were collected during the final weeks of February, before President Donald Trump’s ‘Liberation Day’ and the subsequent bond market volatility.

“Economic stability and competition are the key drivers of mortgage availability – the former has deteriorated since these responses were collected, but the latter has only grown more intense.”

And he added: “Falls in swap rates driven by expectations of slower growth have given the lenders more leeway to cut mortgage rates in an attempt to win market share. Barclays, HSBC and Santander have all made the first moves in what could become a price war on the high street.

“Lenders are also expecting a big increase in remortgaging activity as borrowers seek to lock in new deals as interest rates fall. UK Finance estimates that 1.8 million fixed-rate mortgages will reach the end of their term this year, many of which were agreed back in 2023, when rates were much higher.”