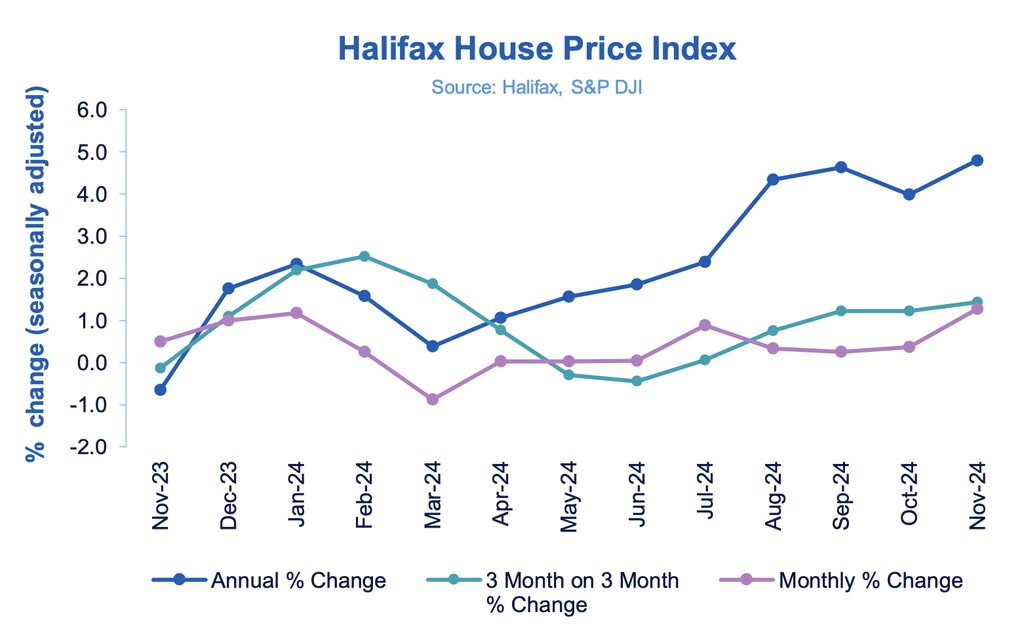

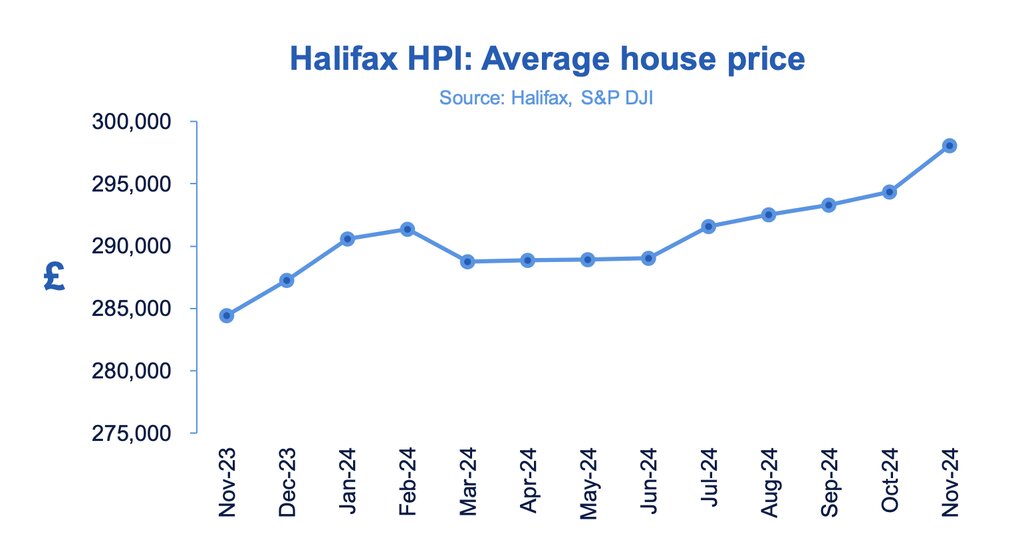

UK house prices increased by 1.3% in November – the fifth consecutive month of growth – taking the average price of a home to a fresh high of almost £300,000, outstripping the previous record set in October.

The Halifax House Price Index also reveals annual growth has also accelerated, rising to 4.8%, with the figures suggesting the market shrugged off any concerns about the housing measures unveiled in Chancellor Rachel Reeves’ debut Budget.

Northern Ireland continues to record the strongest property price growth of any nation or region in the UK, rising by +6.8% on an annual basis in November with properties now costing an average of £203,131.

House prices in Wales also recorded strong growth, up +4.1%, compared to the previous year, with properties now costing an average of £225,084.

STRONGEST GROWTH

House prices in the North West also recorded the strongest growth of any region in England, up +5.9%, compared to the previous year, with properties now costing an average of £237,045.

And properties in the West Midlands also saw strong growth, increasing +5.5% on an annual basis to an average house price of £257,982.

Once again Scotland saw a more modest rise in house prices compared to the rest of the UK, property here now costs £208,957, +2.8% more than the year before.

Meanwhile London retains the top spot for the highest average house price in the UK, at £545,439, up +3.5% compared to last year.

BIGGEST INCREASE THIS YEAR

Amanda Bryden, Head of Mortgages, Halifax, says: “UK house prices rose for the fifth month in a row in November, up by +1.3% in the month – the biggest increase so far this year.

“This pushed the annual growth rate up to +4.8%, its strongest level since November 2022. As a result, the record average house price we saw in October edged higher

still, with a typical property now costing £298,083.”

AFFORDABILITY CHALLENGES

And she adds: “Latest figures continue to show improving levels of demand for mortgages, as an easing in mortgage rates boost buyer confidence. However, despite these positive trends, many potential buyers and movers still face significant affordability challenges and buyer confidence may be tested against a changeable economic backdrop.

“As we move towards the end of the year and into 2025, positive employment figures and anticipated decreases in interest rates are expected to continue supporting demand. This should underpin further house price growth, albeit at a modest pace as borrowing costs remain above the average of a few years ago.”

FOUR RATE CUTS

Mark Harris, chief executive of mortgage broker SPF Private Clients, says: “With the Bank of England Governor suggesting there may be four rate cuts next year, this will bring further cheer to hard-pressed borrowers who are struggling with affordability.

“The Bank of Mum and Dad continues to play a significant role in helping first-time buyers onto the housing ladder. With precious little in the Budget to encourage them, and the stamp duty holiday coming to an end in March 2025, this is not going to get any easier.

“With Swaps continuing to fall, the direction of travel of mortgage rates is downwards although it’s a slow, measured process. Borrowers looking for a mortgage should plan ahead as much as possible and speak to a whole-of-market broker to find the best deal available to them.”

LONG WAY TO GO

Gareth Lewis, managing director of specialist lender MT Finance, adds: “There’s definitely evidence of positivity in the housing market, with an increase in purchases and activity as well as prices.

Gareth Lewis, managing director of specialist lender MT Finance, adds: “There’s definitely evidence of positivity in the housing market, with an increase in purchases and activity as well as prices.

“While this is all encouraging, we still have a long way to go before the market is operating at its full potential. What is required is a better balance of supply and demand, boosting transactions and resulting in true values which reflect this activity.”

COST-OF-LIVING CRISIS

Alice Haine, Personal Finance Analyst at Bestinvest by Evelyn Partners, says: “The Prime Minister has doubled down on his pledge to boost living standards during his parliament and build 1.5 million new homes – measures that have the potential to improve people’s chances of being able to afford a home.

“But the combined effects of the cost-of-living crisis and the higher tax burden of recent years have already dealt a heavy blow to how much money people have left in their pockets after they have paid tax and accounted for inflation.

“And house building targets take some time to materialise – particularly as the policy is likely to result in an escalation in planning rows between developers and local residents despite Keir Starmer’s insistence the process will run more smoothly.”

OCTOBER BUDGET

And she adds: “Add in the risk that inflationary pressures from Rachel Reeve’s raft of spending, borrowing and tax changes in her October Budget keep interest rates higher for longer and affordability may continue to be a challenge for some time.

“Despite mortgage rates easing over the past year, the Budget threw a spanner in the works in November with some lenders choosing to hike rates to reflect shifting interest rate expectations.

“With the BoE widely expected to keep rates on hold this month, it means buyers hoping for mortgage rates to ease further may have to weigh up whether pushing ahead now with a purchase makes more sense than waiting in order to avoid a higher stamp duty bill.”

CONTINUED RECOVERY

Brokers told Newspage what they thought of the latest Halifax HPI data.

Rohit Kohli, director at The Mortgage Stop: “The Halifax data shows a continued recovery in the housing market, with house prices rising for the fifth consecutive month and annual growth now at 4.8%.

“It’s encouraging to see strong performance in regions like Northern Ireland, the North West and the West Midlands, highlighting the resilience of local markets.

“However, affordability challenges remain a concern, especially with borrowing costs still above pre-pandemic levels.

“Recent spikes in rates, driven by market reactions to government actions like the Budget, show how fragile confidence remains.

“The Labour government needs to wake up to the fact that businesses and borrowers are crying out for stability and certainty. Without decisive action to restore confidence, these positive trends risk being short-lived.”

ROSY PICTURE

Stephen Perkins, managing director at Yellow Brick Mortgages: “The Halifax index mirrors the Nationwide one last week, showing that a lack of supply is still driving up prices despite the economic undercurrents. This data paints a rosy picture but the real picture is anything but.”

HOT STREAK

Patricia McGirr, founder at Repossession Rescue Network: “House prices are on a hot streak, but let’s not mistake momentum for stability. A 4.8% annual rise sounds like a win, until you factor in volatile mortgage rates, cash-strapped buyers and a Budget that offered homeowners and businesses little reprieve. The market’s resilience is impressive, but it’s a precarious balancing act.”

STILL A CHALLENGE

Emma Jones, Managing Director at Whenthebanksaysno.co.uk: “Modest house price growth certainly looks likely in 2025 as the economy grapples with the impact of the Budget and affordability issues persist.

“Mortgage rates are higher than what they were for a long time and, even though they’ve started to come down this week, they are still a challenge for many.”

STAYING POWER

Ranald Mitchell, Director at Charwin Mortgages: “House prices are rising faster than Christmas shopping bills, with a 1.3% bump in November and 4.8% annual growth.

“It seems the UK housing market has more staying power than a mince pie at a Christmas party. While sellers have reason to celebrate, first-time buyers might be feeling like they’re on Santa’s naughty list.

“Let’s see if this momentum carries into the new year or if the market finally decides to take a nap after the festivities.”

REASSURING NEWS

Ben Perks, Managing Director at Orchard Financial Advisers: “Reassuring news for homeowners. Despite the economy being flaky across many sectors, bricks and mortar remains strong. Welcome news after a more positive week for mortgage rates.”

SOMETHING TO SMILE ABOUT

Simon Bridgland, Director at Release Freedom: “What’s not to like? A good run of five months’ continuous growth will filter through to the home owning public’s sentiment. Carried along with some year end fixed rate price drops, this should give home owners something to smile about.

“The numbers in the story are not all good news though, the aspirations of so many working people, giving blood, sweat and tears to pull together the resources to be able to buy are being dealt a double whammy, the continued increase in price, and now the looming SDLT increases as the honeymoon period of reduced rate and FTB discount is removed come 30th March. One step forward, two back for the wannabe homeowner.”

GROWING MOMENTUM

Iain Swatton, Director at Exemplar Financial Services: “The Halifax House Price Index shows a 1.3% rise in November, following similar figures from Nationwide earlier this week, highlights the housing market’s resilience.

“With the spring stamp duty deadline approaching and recent rate reductions providing a boost, there’s growing momentum that could carry the market into 2025 with cautious optimism.”