UK house prices remained broadly unchanged in June signalling renewed stability in the property market as buyer activity continues to recover, latest figures from Halifax reveal.

The average UK property price stood at £296,665, a marginal dip of just £117 from May’s figure of £296,782.

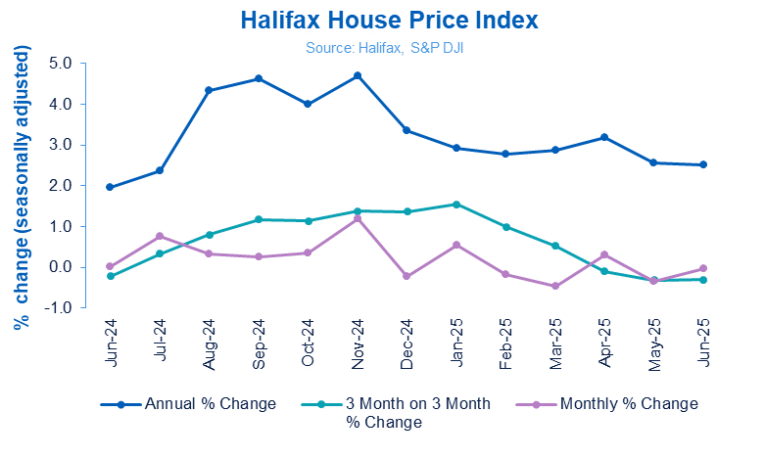

Monthly growth was flat at 0.0%, following a slight decline of -0.3% in May, while annual house price inflation edged down to +2.5%, from +2.6% the previous month.

The figures suggest the housing market is regaining momentum after a brief slowdown earlier this year, triggered in part by changes to stamp duty thresholds.

FLEXIBLE AFFORDABILITY

Amanda Bryden, Head of Mortgages at Halifax, said: “The market’s resilience continues to stand out. Mortgage approvals and property transactions have both picked up, with more buyers returning to the market.

“That’s being helped by rising wages, greater confidence around interest rates, and more flexible affordability assessments from lenders.”

Bryden said Halifax alone has helped an additional 3,000 buyers over the past two months access mortgages they would previously not have qualified for, including over 1,000 first-time buyers.

While affordability remains stretched, particularly for those coming off low fixed-rate deals, further improvement is expected in the months ahead.

RATE CUTS AHEAD

Byden added: “Markets are pricing in two more rate cuts from the Bank of England by year end. With newly drawn mortgage rates now at their lowest since 2023, we expect modest house price growth in the second half of the year.”

Regionally, Northern Ireland continued to lead annual price growth, with average values up +9.6% year-on-year to £212,189. Scotland followed with growth of +4.9% to £214,891, and Wales recorded a +3.9% increase to £229,622.

Among English regions, the North West outperformed, with prices up +4.4% over the year to £241,938. London and the South West saw more subdued growth of just +0.6% and +0.5%, respectively, though the capital remains the UK’s most expensive market with an average price of £540,048.

INDUSTRY REACTION

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: “Mortgage rates are only part of the picture – the easing of criteria and changes to mortgage stress tests by lenders such as Nationwide and NatWest, following changes to Bank of England guidance in March, means tens of thousands of pounds of extra borrowing may now be available to buyers.

“This is boosting affordability, enabling more borrowers to get the mortgages they need. If interest rates fall further, as expected, this will give a further boost to activity and transactions later in the year.”

HOUSE PRICES HOLDING UP

Karen Noye, mortgage expert at Quilter, said: “Today’s house price index looks a little more positive than other indices already published which reported a fall in prices.

“While the changes to stamp duty coupled with the ongoing affordability pressures are still weighing on the market, Halifax’s print suggests house prices seem to be holding up relatively well.

“The market has been resilient but there are still challenges to contend with. Prospective buyers had been clinging onto hopes that mortgage rates would continue to fall, but progress has mostly stalled for now.

“With the summer holidays fast approaching, we could see a slowdown.”

“With the summer holidays fast approaching, we could see a slowdown as trips abroad take precedence over moving home. The market is used to a dip in momentum during this time of the year but having already had a fairly slow start to 2025, we could see this lull push house prices down a little more.

“However, while we may not see activity pick up until nearer the autumn, by that time the stamp duty changes will have sunk in. Buyers will have no choice but to adjust to the new norm if they wish to move home, and we could see the market pick up some pace as a result.”

STRONG MONTH

Tomer Aboody, director of specialist lender MT Finance, said: “June turned out to be a stronger month for the market compared to the previous one, with more buyers returning, especially first-time purchasers, as interest rates remain steady and lenders are more flexible when it comes to mortgage approvals.

“Sales numbers still need to improve; with fewer properties on the market, encouragement is required via a reform in stamp duty.”

NOT THE START OF THE REBOUND

Tom Bill, head of UK residential research at Knight Frank, said: “House prices may have held steady, but high supply and weak demand suggest this is not the start of a rebound.

“New listings were 9% higher than last year between January and June but new prospective buyers were down by 8%.

“Supply is higher following the stamp duty cliff edge in March and as more landlords sell, but consumer confidence remains weak after economic activity was pulled forward into the first quarter of the year.

“We expect modest single-digit house price growth in 2025 as rates come down in the second half of the year but asking prices need to reflect the fact it is very much a buyer’s market.”

HEIGHTENED ACTIVITY

And Guy Gittins, Foxtons CEO, added: “Despite house price growth remaining flat on a month to month basis, today’s Halifax figures continue to illustrate the strength in the market with the longer-term view of market health showing house prices remain higher on an annual basis.

“We’ve already seen a heightened degree of activity over the first six months of the year and, as we head into H2, our expectation is that market activity will continue to strengthen.”