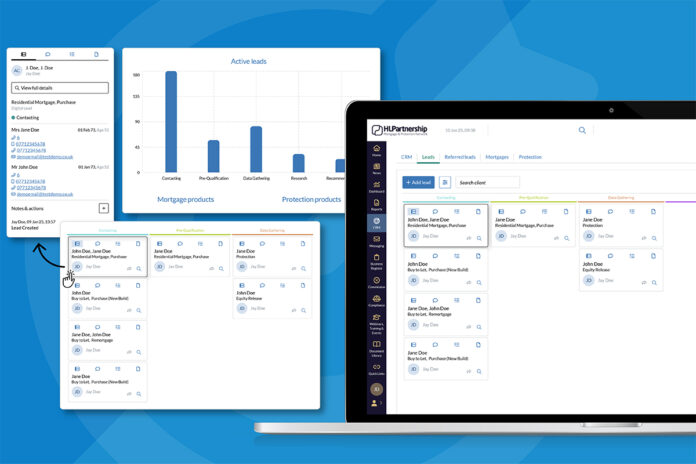

HLPartnership (HLP) has launched a new CRM system which was developed in-house.

The system was designed specifically for use by mortgage and protection advisers and the network claims the platform integrates “every aspect” of the advice journey.

HLP says it has invested significantly in its in-house technology capabilities over recent years, with David Steele, its chief technology officer, leading the team which developed the new platform.

Key features of the CRM system include integrated tools, client and workload management functionality, compliance support, “enhanced” case management and “future-focused” development of the platform over time.

As part of its phased rollout, HLP is providing members with training programmes and access to dedicated system support teams.

Christopher Tanner, CEO of HLP, said: “Technology has always been a key focus for HLP, and we recognise its vital role in preparing advisers for the future. This launch marks the beginning of an exciting new chapter for HLP, as our strategic partnership with BetterHome Group allows us to accelerate the development of member-led technology while harnessing their expertise alongside our own.

Christopher Tanner, CEO of HLP, said: “Technology has always been a key focus for HLP, and we recognise its vital role in preparing advisers for the future. This launch marks the beginning of an exciting new chapter for HLP, as our strategic partnership with BetterHome Group allows us to accelerate the development of member-led technology while harnessing their expertise alongside our own.

“We understand the challenges of running a successful advice business, which is why our CRM system is more than just software—it is a comprehensive solution created by advisers, for advisers. It simplifies processes, boosts productivity, and focuses on what matters most: efficiency, compliance, and client outcomes. Designed to grow with businesses, it provides long-term value for our members.

“Thanks to our partnership with BetterHome Group, we are pushing the boundaries of innovation and delivering tools that meet the evolving needs of advisers and their clients. At HLPartnership, we listen, innovate, and deliver, always putting advisers and their clients at the centre of everything we do. Our significant investment in bespoke technology reflects our commitment to helping our members succeed today and in the future.”