The Help to Buy scheme has been slammed by the Labour party, which says it does little to bring cost of housing within reach of low and middle income earners.

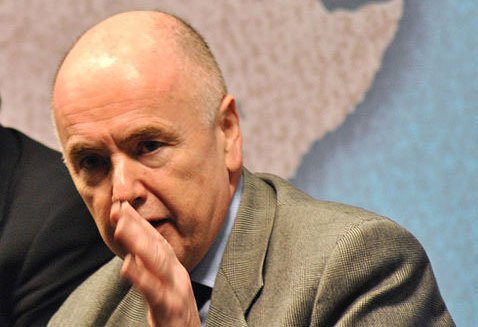

Jack Dromey MP (pictured), Labour’s Shadow Housing Minister, responded to the latest government announcement on the Help to Buy scheme, by saying: “Any help for first time buyers struggling to get on the property ladder is to be welcomed.

“But there is now widespread criticism that this scheme will do little to bring the cost of housing within the reach of low and middle income earners.

“Unless the Government finally acts to build more affordable homes, then home ownership for millions of first time buyers will remain but a dream.

“If the £10bn infrastructure boost recommended by the IMF was spent on housing, we could build 400,000 affordable homes and support 600,000 jobs.

“That’s the way to get people back to work, sort out the housing crisis and strengthen our economy for the long term.”