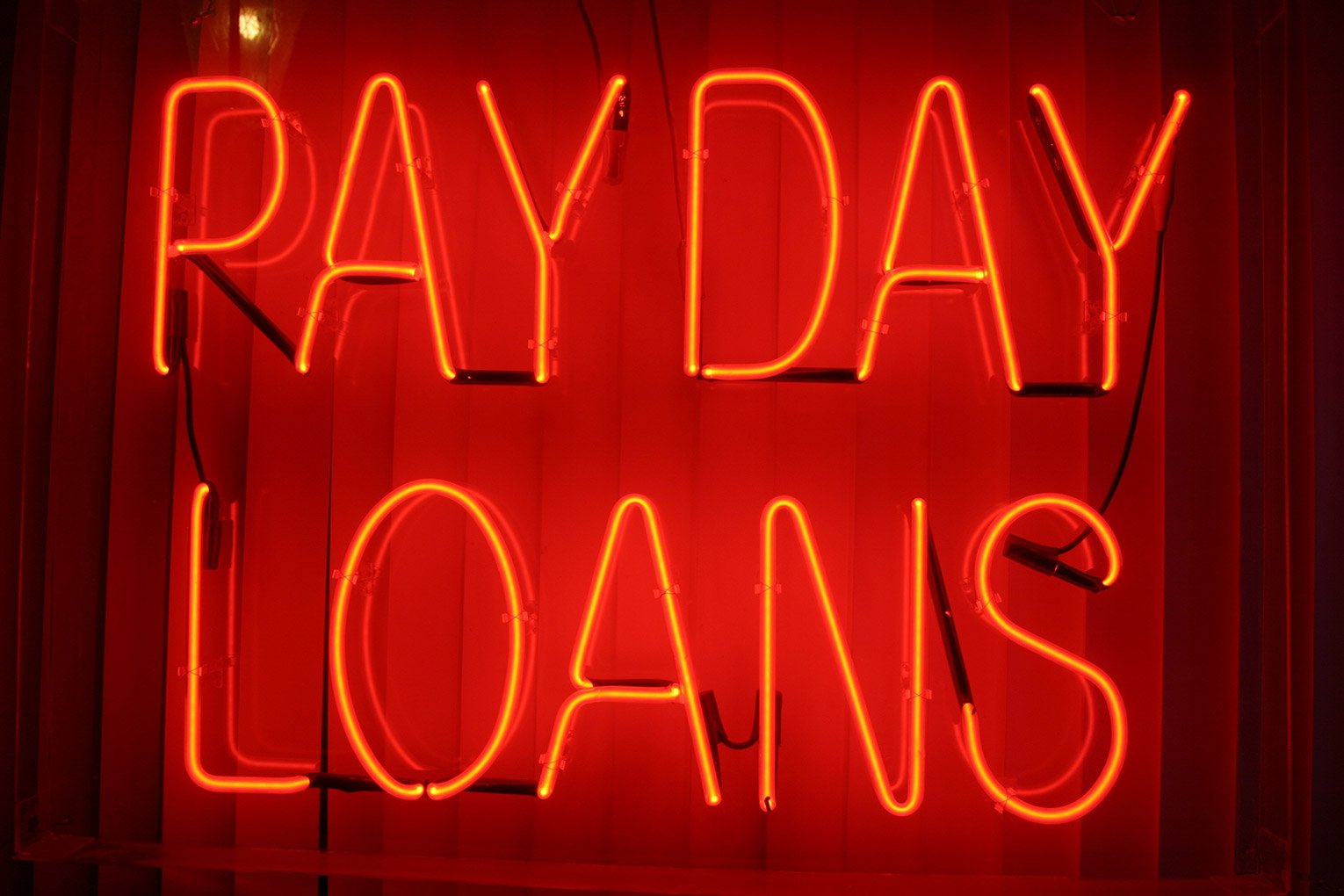

Google says it is banning ads for payday loans and some related products from its ads systems.

The internet giant will no longer allow ads for loans where repayment is due within 60 days of the date of issue. In the U.S., It is also banning ads for loans with an APR of 36% or higher.

Google says its research has shown that these loans can result in unaffordable payment and high default rates for users.

This change is designed to protect its users from deceptive or harmful financial products and will not affect companies offering loans such as mortgages, car loans, student loans, commercial loans and revolving lines of credit (e.g. credit cards).

Wade Henderson, president and CEO of The Leadership Conference on Civil and Human Rights, said: “This new policy addresses many of the longstanding concerns shared by the entire civil rights community about predatory payday lending. These companies have long used slick advertising and aggressive marketing to trap consumers into outrageously high interest loans – often those least able to afford it.”