Legal & General has moved to gender neutral pricing.

This means all individual protection products will be quoted using gender-neutral pricing. All new quotes given to customers from today will show the gender-neutral premiums for both males and females and will be guaranteed for 90 day s.

s.

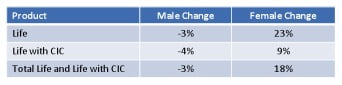

On average, female premiums have risen by just under 20%. The table below gives examples of average premium changes. L&G said the premium change will vary depending for each individual customer so advisers should check by getting a quote.

The insurers said this was its initial pricing stance competing against the market, which is still on gender specific premiums.

“As the leader in the protection market we’re moving to gender-neutral pricing early to provide the certainty we believe advisers and their customers need,” said Stuart Welch, actuarial director for individual protection, Legal & General.

“The new quotes come with a 90 day guarantee so advisers can begin to think about next year’s pipeline with that clarity.

“It’s likely that the market will see some volatility in the aftermath of all the different moves to gender-neutral rates and this will continue into 2013.”