First-time buyers are fuelling the busiest year for the housing market since 2022 with sales rising sharply even as house price growth remains subdued.

Zoopla’s latest House Price Index reveals the UK is on track for around 1.2m property transactions in 2025 – up 9% on last year – as more buyers take advantage of stable mortgage rates and rising household incomes.

However, while more homes are changing hands, prices are rising at a much slower pace.

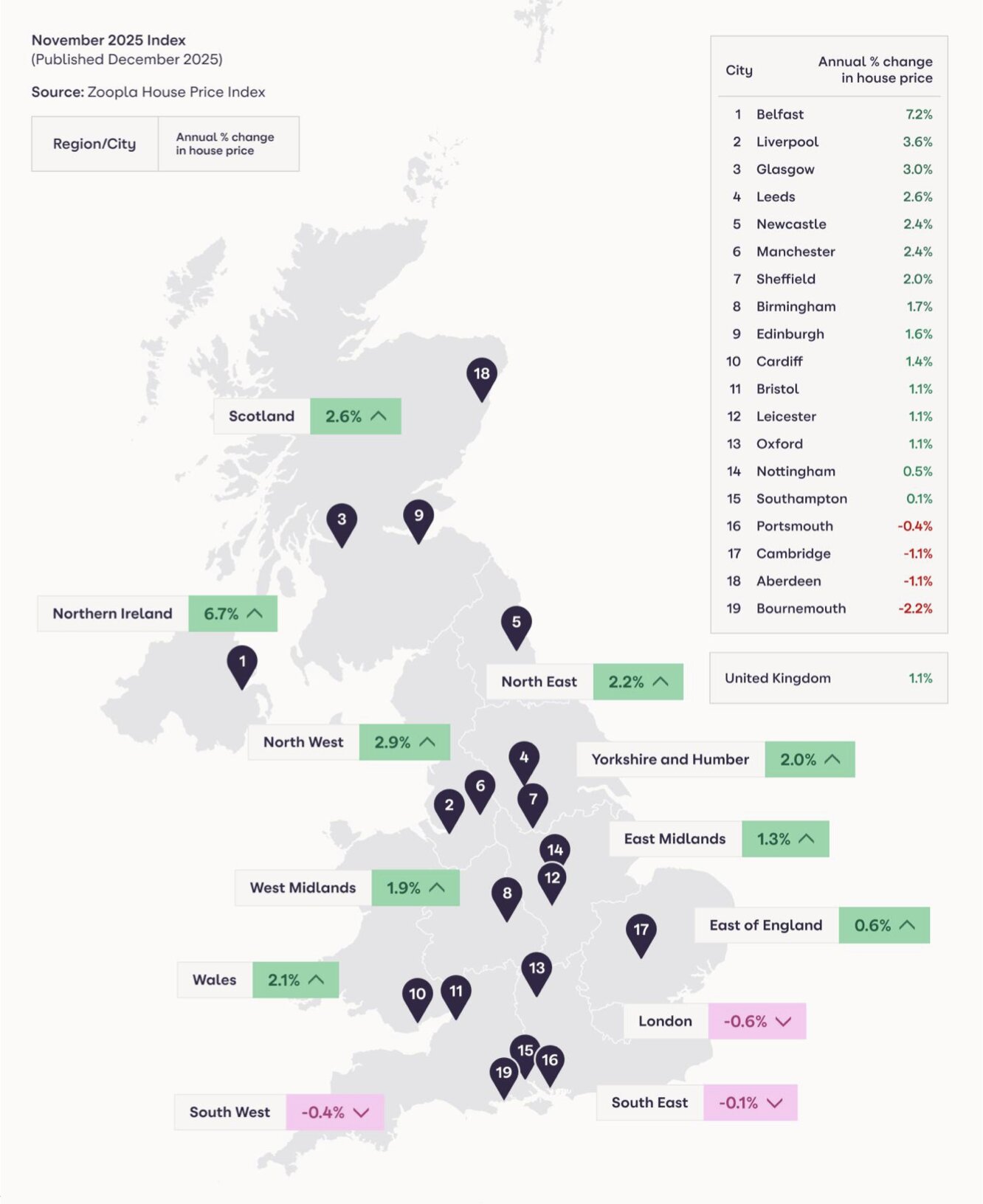

The average UK home now costs £270,300, just 1.1% higher than a year ago and well below the long-term average rate of growth.

NORTH-SOUTH DIVIDE

A growing north-south divide is once again shaping the market. Prices are rising fastest in more affordable areas, with the North West seeing growth of 2.9% and Northern Ireland surging ahead with gains of 6.7%.

In contrast, values are falling across much of southern England and are down by up to 0.6% in London, where high prices and stamp duty bills are putting buyers off.

Some of the strongest price rises have been recorded in unexpected locations. The Scottish Borders has seen values climb by 4.7%, while Oldham (4.4%), Kirkcaldy (4.2%) and Falkirk (4.2%) have also performed strongly.

COASTAL SLIDE

Meanwhile, several southern coastal towns are seeing prices slide as second-home taxes bite and more workers return to the office. House prices are down 2.4% in Truro, 1.9% in Torquay and 1.8% in Bournemouth.

First-time buyers are the driving force behind the increase in sales. Their numbers are expected to be 20% higher this year, accounting for almost two in five purchases. Existing homeowners using a mortgage make up a third of sales, while cash buyers account for 21% and buy-to-let landlords just 7%.

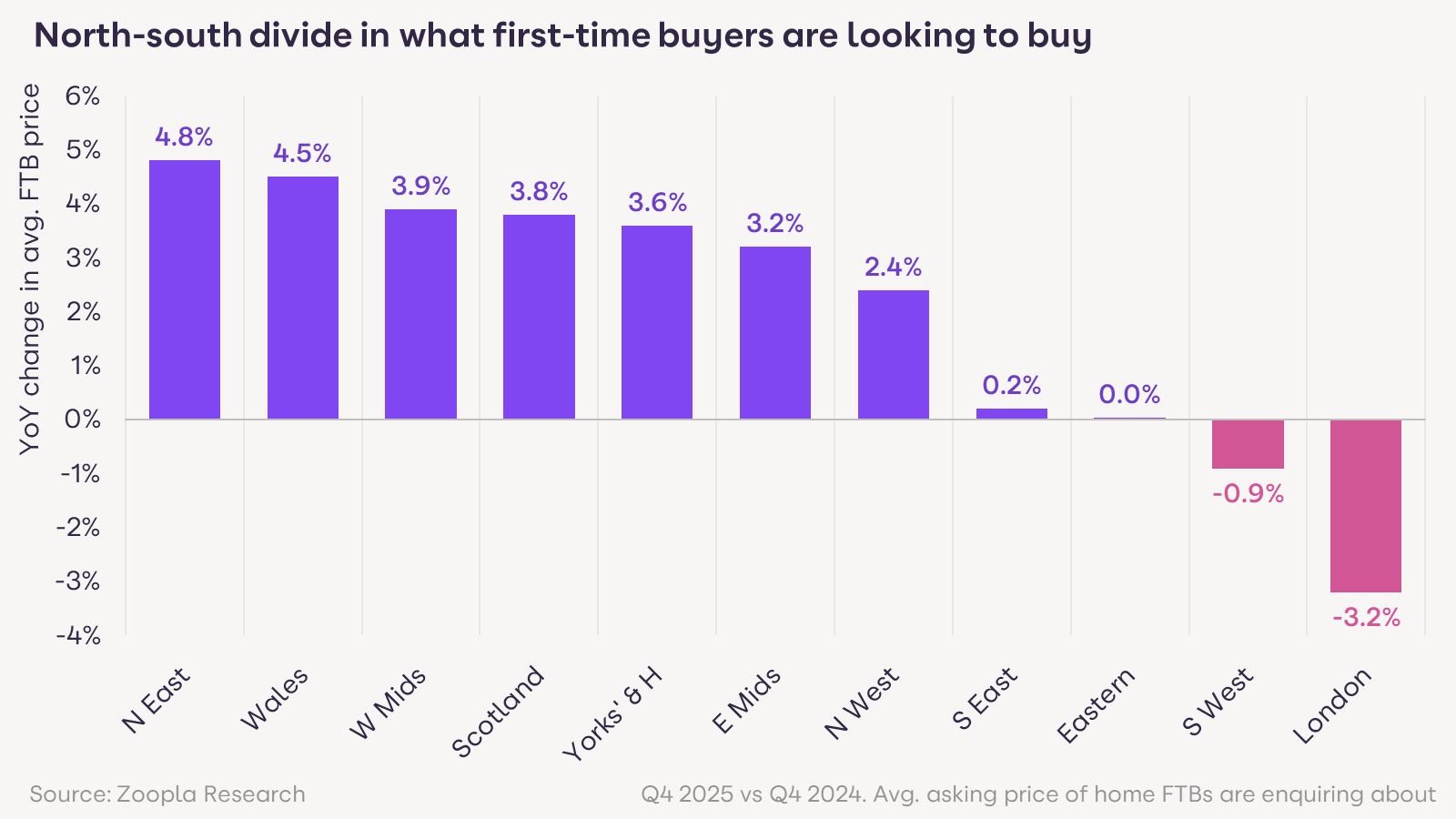

Despite being able to borrow more, first-time buyers are not splashing out.

Despite being able to borrow more, first-time buyers are not splashing out. In London, they are looking for homes around 3% cheaper than a year ago, while in regional markets they are prepared to spend up to 5% more, reflecting better affordability outside the capital.

Looking ahead, Zoopla expects house prices to rise by 1.5% in 2026, helped by a release of pent-up demand as buyers who delayed decisions ahead of the Budget return to the market. Sales are forecast to reach around 1.18m next year.

Growth is expected to remain strongest in the Midlands, northern England, Scotland and Northern Ireland, where prices are forecast to rise by more than 2.5%, cementing the widening gap between North and South.

AFFORDABILITY STILL A CONSTRAINT

Richard Donnell, executive director at Zoopla, said: “2025 has been a strong year for home moves but the Budget hit activity in the final months of the year and saw many moving decisions put on hold.

“Now the uncertainty has lifted, we expect a stronger than usual start to 2026 as buyers return to the market.

“The appetite to move home remains strong but affordability remains a constraint for those buying their first home or looking to trade-up to a larger home which will keep prices in check.”

REALISTIC PRICING

And he added: “There remains plenty of homes for sale, which will boost buyer choice as we start the new year. Average UK house prices are projected to be 1.5% higher over 2026 with a continued divide between southern England and the rest of the country where affordability is better and buying costs are lower.

“It is important that sellers remain realistic on pricing to secure sales in 2026, especially across southern England. Homeowners looking to move in the year ahead should understand the value of their home and what they can afford before starting their property search.”

valuations and data for agreed sales. The index uses more input data than any other and is

designed to accurately track the change in pricing for UK housing.