First-time buyers are grappling with significantly higher monthly mortgage payments than they were five years ago, latest data from Rightmove reveals.

The typical monthly mortgage payment for a first-time buyer property – usually a home with two bedrooms or fewer – has risen to £940, compared to £590 in 2020.

Although there have been some improvements in the mortgage market since last year, the current figure is still £155 lower than the peak seen in 2023.

Rightmove’s study assumes that a first-time buyer has managed to save a 20% deposit and is spreading their mortgage payments over 30 years.

Despite the steep increase in monthly payments, average wage growth has outpaced the rise in house prices for first-time buyer properties.

Over the past five years, average earnings have grown by 30%, while the price of a typical first-time buyer home has increased by 17%.

BOOSTING BORROWING POWER

This has slightly boosted the borrowing power of first-time buyers, with lenders typically offering loans up to 4.5 times a single or joint income.

However, affordability remains a pressing issue. Rightmove has welcomed recent discussions by the mortgage regulator about exploring responsible ways to allow first-time buyers to borrow more, acknowledging that current lending limits continue to be a barrier for many aspiring homeowners.

However the regional divide in affordability remains stark. In London, the average price of a first-time buyer property now stands at £500,066 – equivalent to 6.8 times the national average wage for a joint income. In contrast, the North East presents a more accessible option, with the average first-time buyer home priced at £132,854, or just 1.8 times a joint income.

GREATER CHALLENGES

The challenge is even greater for those hoping to buy alone. Rightmove’s data shows that in more than half of UK regions, a solo first-time buyer on an average salary would struggle to afford a typical starter home – even with a 10% deposit and a mortgage capped at 4.5 times their income.

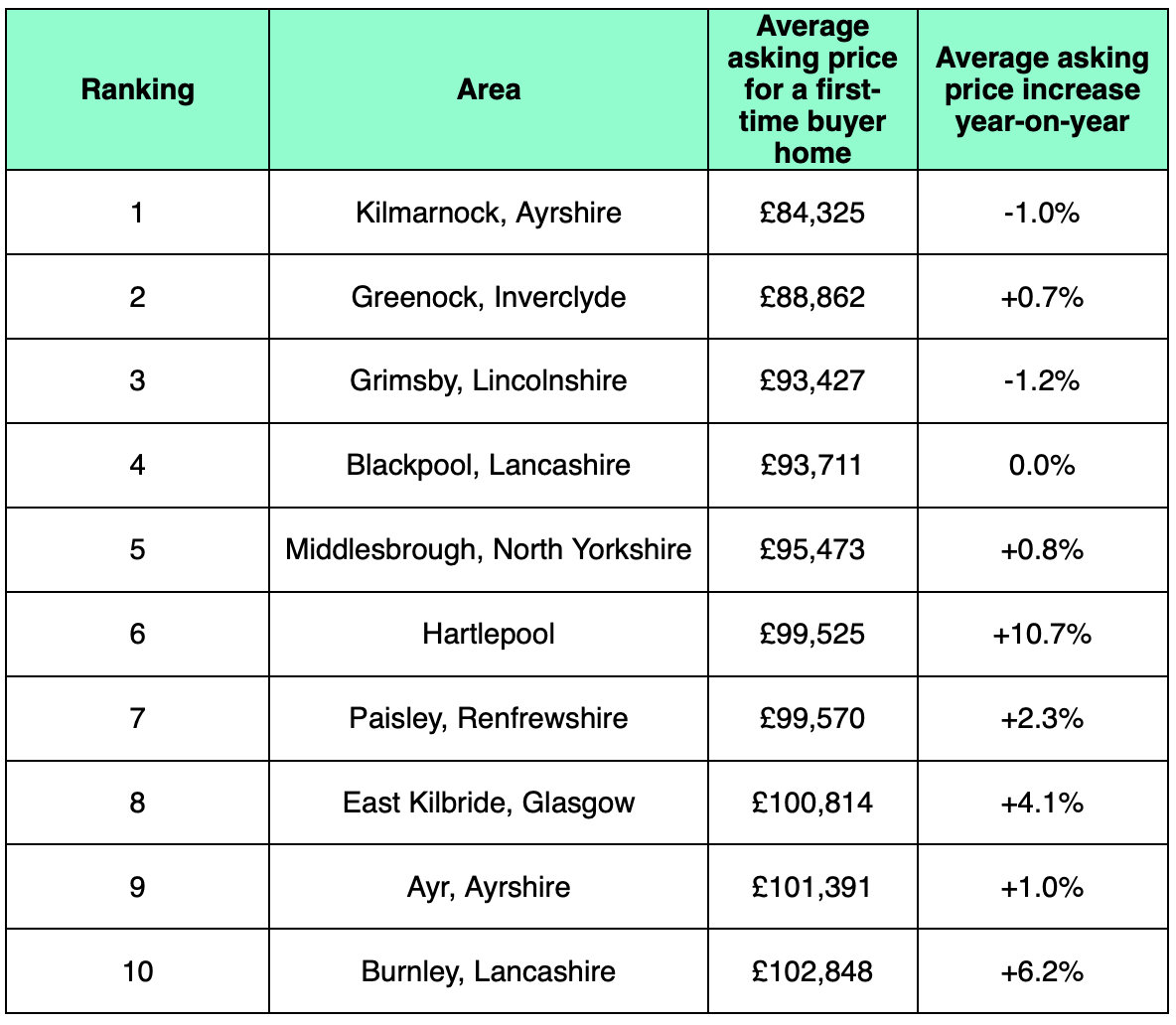

For those open to relocating, some areas offer more affordable options. Kilmarnock in Ayrshire tops the list as the cheapest place for first-time buyers to step onto the property ladder, with an average asking price of £84,325. Greenock in Inverclyde follows at £88,862, and Grimsby in Lincolnshire ranks third at £93,427.

UNLOCKING OPPORTUNITY

Rightmove’s mortgage expert Matt Smith said: “Higher mortgage rates mean home-movers need to consider how much they can afford to pay each month on a monthly mortgage, even if they can meet the asking price of a home.

“Another measure of affordability which is restricting some first-time buyers from getting onto the ladder is how much they can borrow.

“It’s encouraging to see that the regulator is considering how they may be able to enable first-time buyers to borrow more in a responsible way, as we think this will help to unlock more opportunity, particularly for those with smaller deposits.”

CHEAPEST LOCATIONS FOR FIRST-TIME BUYERS