First-time buyer affordability is showing tentative signs of improvement with average monthly mortgage payments down nearly £100 compared to this time last year, latest analysis from Rightmove reveals.

Ahead of today’s Bank of England rate decision, the portal reports that the typical monthly mortgage cost for a first-time buyer has fallen to £909, down from £1,002 last August – a saving of £93.

The calculation is based on a buyer purchasing a property with two bedrooms or fewer, using a 20% deposit and taking out a 30-year mortgage.

DECLINING RATES

The reduction comes as mortgage rates have steadily declined. The average 2-year fixed rate for a borrower with a 20% deposit has dropped from 5.21% last year to 4.38%, while the 5-year fixed average has fallen from 4.91% to 4.52%.

Importantly, average asking prices for first-time buyer properties have remained broadly flat over the past 12 months – currently £227,466, compared to £227,924 this time last year.

At the same time, average earnings have risen by around 5%, providing a modest but meaningful boost to buyer affordability.

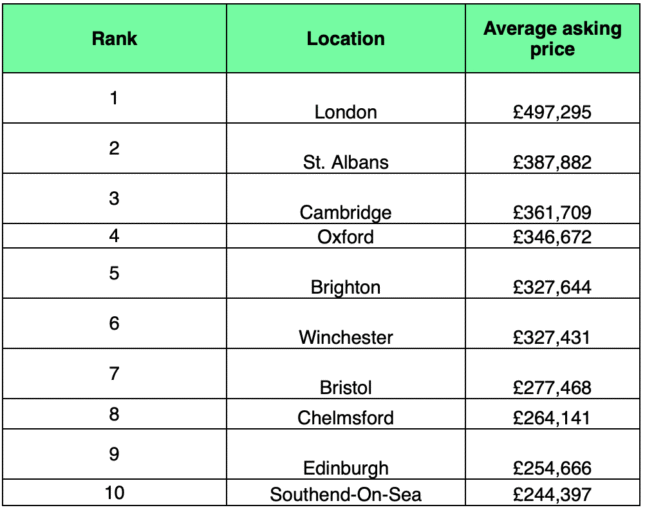

London continues to present the biggest affordability challenge, with the average asking price for a first-time buyer home now £497,295.

Source: Rightmove

But even in the capital, monthly mortgage payments are down by around £240 year-on-year.

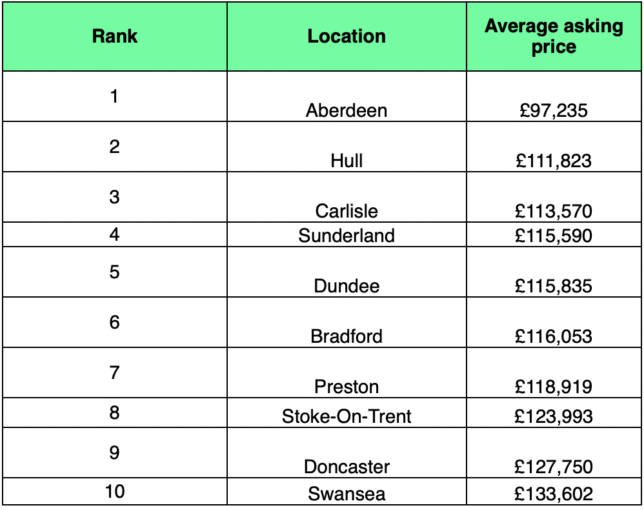

At the other end of the spectrum, the most affordable cities for first-time buyers are Aberdeen, Hull and Carlisle, while St Albans and Cambridge rank among the most expensive after London.

AFFORDABILITY FACTOR

Colleen Babcock, Rightmove’s property expert, says: “Affordability is still playing a key role in market activity right now.

“The factors which contribute to buyer affordability are improving, and if we see further Bank Rate reductions this year followed by mortgage rate drops, this could spur more buyers on during the second half of this year.”

Source: Rightmove