First-time buyers are seeing the most favourable affordability conditions in almost a decade, according to new research from Lloyds.

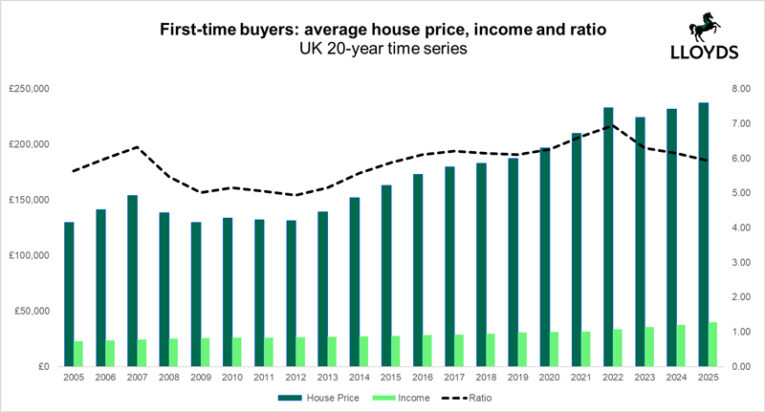

A combination of slower house price growth, rising wages and lower mortgage rates has pushed the typical price-to-income ratio for a first home down to five point nine times average earnings, its lowest level since 2015.

The average first-time buyer property now costs £237,518. While this is up by 2.4% on last year, average earnings have risen more quickly, increasing by 6.2% to £40,021. Lloyds said the shift marks a notable improvement following the sharp rise in rates in 2022.

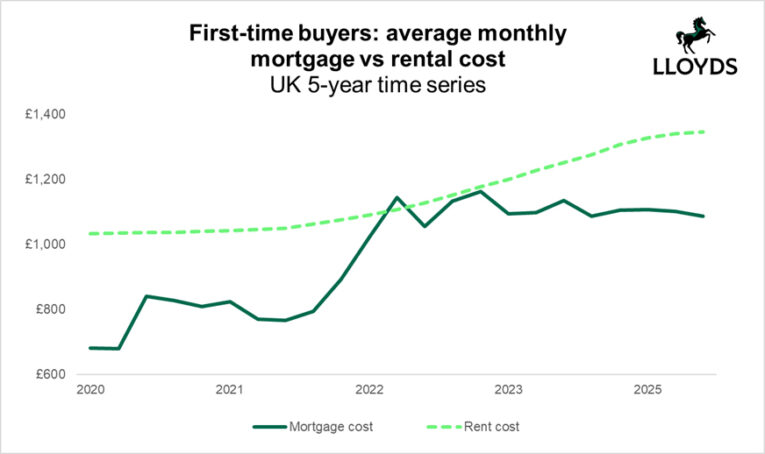

Monthly mortgage payments have remained broadly steady. A typical first-time buyer mortgage now costs £1,087 per month, just 0.1% higher than a year ago. Calculations were based on a five-year fixed rate at 4.5% with a 10% deposit and a 30-year term. This represents a slight fall in the average rate from 4.7% last year.

As a proportion of income, mortgage payments have fallen from 34.6% to 32.6%, the lowest level since the middle of 2022.

BUYERS FACE DIFFERENT CONDITIONS BY REGION

Lloyds’ data indicates that affordability has improved across most of the UK, although regional disparity remains pronounced. Greater London, the South East, Eastern England and the South West recorded the largest improvements in price-to-income ratios, each falling by zero point four over the year. These regions remain the most expensive parts of the country for first-time buyers.

The North East continues to be the most affordable region with a property price-to-income ratio of three point nine. Mortgage costs there account for around 22% of income. By contrast, buyers in Greater London face mortgage payments equating to about 51% of earnings.

Scotland and Wales both saw relatively stable affordability levels. Scotland’s ratio remains at four point zero, while Wales improved slightly to five point three. Northern Ireland rose to five point one.

| Most and least affordable local areas by region or nation | |||

| Region | Local area | Property price | Price to income ratio |

| East Midlands | Mansfield | £166,604 | 4.6 |

| Rutland and Melton | £322,458 | 8.8 | |

| Eastern England | Boston and South Holland | £188,437 | 4.8 |

| St Albans | £544,099 | 13.7 | |

| Greater London | Barking and Dagenham | £313,270 | 6.2 |

| Kensington and Chelsea | £888,085 | 17.7 | |

| North East | South Tyneside | £134,671 | 3.8 |

| Northumberland | £210,960 | 5.9 | |

| North West | Blackpool | £138,206 | 3.6 |

| Trafford | £354,819 | 9.3 | |

| Scotland | Inverclyde | £136,599 | 3.4 |

| East Renfrewshire | £289,277 | 7.1 | |

| South East | Portsmouth | £212,331 | 5.1 |

| Elmbridge | £688,483 | 16.6 | |

| South West | Plymouth | £197,922 | 5.1 |

| Cotswolds | £368,300 | 9.6 | |

| Wales | Neath Port Talbot | £148,527 | 4.0 |

| Monmouthshire | £309,357 | 8.3 | |

| West Midlands | Stoke-On-Trent | £153,573 | 4.0 |

| Stratford-on-Avon | £339,382 | 8.9 | |

| Yorkshire & the Humber | Kingston upon Hull | £128,366 | 3.5 |

| North Yorkshire | £277,825 | 7.5 | |

Source: Lloyds Banking Group, ONS

FROM INVERCLYDE TO CHELSEA

At a local level, Inverclyde is the most affordable area in Britain with a price-to-earnings ratio of three point four. Kingston upon Hull, South Tyneside and Blackpool also appear among the most accessible markets.

Kensington and Chelsea remains the least affordable with a ratio of 17.7, followed by Elmbridge in the South East at 16.6. The Cotswolds recorded the biggest improvement over the year, with its ratio falling from 12.0 to 9.6 due to a decline in the average home value. Staffordshire Moorlands experienced the sharpest deterioration, rising from 5.7 to 6.3 as prices increased.

RENTAL COSTS CONTINUE TO OUTPACE MORTGAGE PAYMENTS

Rents rose by 5.5% over the past year to an average of £1,346 per month. Despite strong wage growth helping to stabilise rental affordability at around 40% of income, renting now costs an average of £259 more per month than a typical first-time buyer mortgage.

Lloyds said this widening gap underlines the longer-term value of homeownership for those able to raise a deposit.

JOINT APPLICATIONS BOOST BORROWING POWER

The lender noted that most first-time buyers now rely on more than one income. Some 62% of new purchasers apply jointly with a partner, friend or family member. UK Finance figures put the average household income for a first-time buyer mortgage at just over £65,000. On that basis, the price-to-income ratio falls to around 3.7, with mortgage costs nearer to 20% of joint earnings.

Amanda Bryden, head of mortgages at Lloyds, said: “Buying your first home is still a big challenge, but things are moving in the right direction.

“Lower mortgage rates, stronger wages and slower house price growth mean it’s becoming a little easier to get on the ladder – the best it’s been for several years.”

She added: “Big national numbers often make the headlines, but the reality is that the housing market can look very different from one town to the next. If you’re searching for your first home, being flexible on location can really help – sometimes moving just a few miles from your preferred area can unlock much better value.”

Mary-Lou Press, NAEA Propertymark president, said: “While it is encouraging to witness an emerging trend of falling rates on offer across many key mortgage products, as well as rising wages which are helping to enhance first-time buyer affordability, the Autumn Budget seemed like a missed opportunity in many ways to further energise the housing market overall.”

She continued: “With a population expected to exceed 70m people in less than five years, there is vast pressure to deliver new homes across all regions.

“Over the forthcoming year it will prove essential to see investment in the correct skillset and supply chains to enable this objective to become a reality.”