Only 8% have critical illness insurance and only 33% have life cover, according to Scottish Widows.

This is despite the fact that people are four times more likely to claim on a critical illness policy than a life insurance policy before the age of 65.

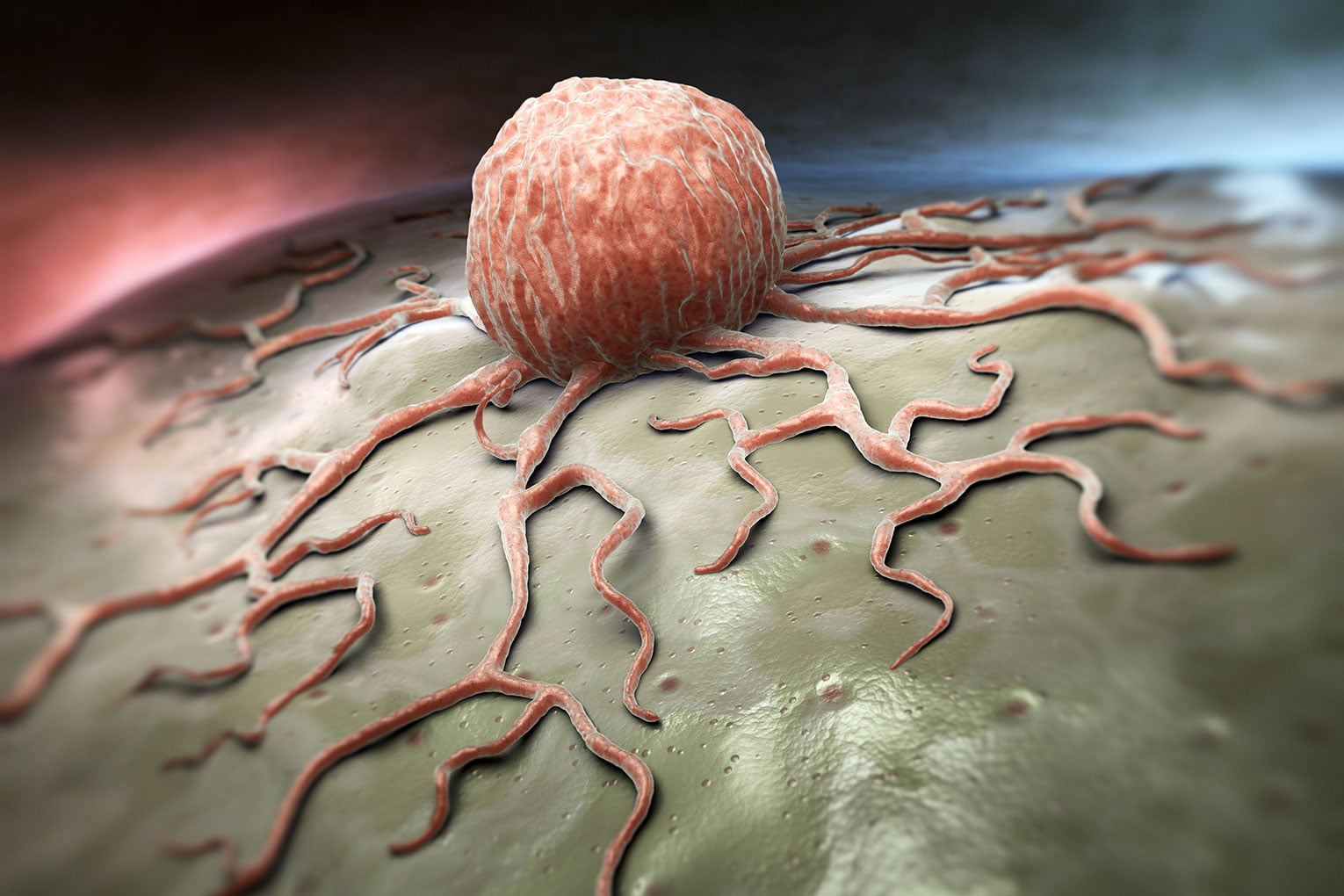

With three national cancer awareness campaigns taking place in March – Prostate Cancer, Ovarian Cancer and Brain Tumour – Scottish Widows is highlighting the fact that Britons are “woefully under-protected” should serious illness strike.

Prostate cancer is the most common cause of cancer in men in the UK, with around 130 being diagnosed every day and one in eight having this type of cancer during their lifetime. And ovarian cancer is the sixth most common cancer in females in the UK, with around 20 women being diagnosed every day.

In the meantime,16,000 people each year are diagnosed with a brain tumour, and more children and adults under 40 die of a brain tumour than from any other cancer.

Scottish Widows paid out more than £5.5million in critical illness claims relating to prostate cancer, ovarian cancer and brain tumours in 2014, which collectively accounted for more than 10% of all cancer claims that year.

The average age of diagnosis for prostate cancer in 2014 was 56, while the average age for ovarian cancer was 50. Almost three quarters (74%) of brain tumour claimants were male, with the youngest just 13 years of age.

Scott Cadger, head of underwriting and claims strategy at Scottish Widows, said: “While medical advances mean that more people are surviving conditions that might have caused death in earlier generations, financial protection is becoming a decreasing priority for most of us.

“Our research has revealed that 80% of us consider broadband as essential for daily living, while 71% can’t get by without a mobile phone. In contrast, only 28% of us feel that protecting our families in case we become critically ill or unable to work is a necessity.

“Although the here and now tends to dominate when it comes to the way we assess our needs, it’s more important now than ever to have an appropriate plan in place at the right time to protect our homes and families.”