The Financial Conduct Authority (FCA) is seeking views and evidence of the challenges firms face in providing travel insurance for consumers who have, or have had, cancer, and the challenges for these consumers in accessing insurance.

The paper is also looking at the reasons for pricing differences in premiums quoted.

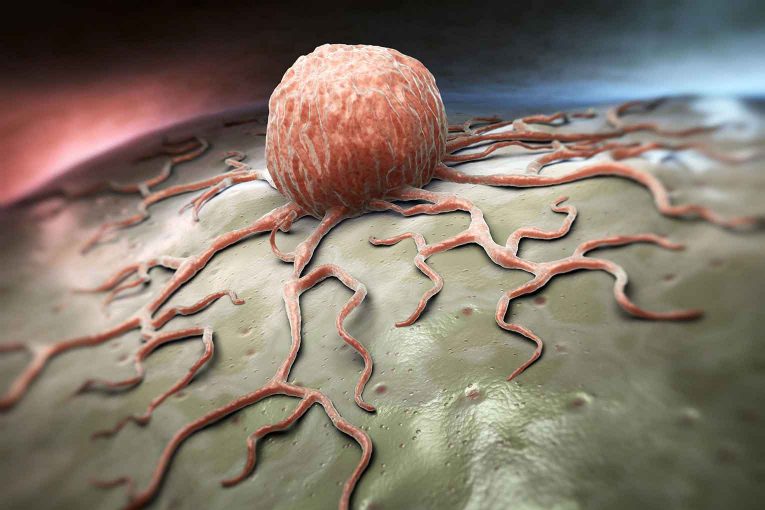

The regulator said its paper looks more broadly at access issues related to insurance but specifically seeks views on how consumers with cancer or those in recovery can access the travel insurance market.

This is the FCA’s next step to address issues highlighted in the Occasional Paper on ‘Access to Financial Services in the UK’, published last year. This focused on problems consumers can face when trying to find insurance that meets their needs.

Christopher Woolard, executive director of strategy and competition at the FCA, said: “Being able to access financial services is critical for people to fully participate in society. We hope that this will encourage discussion on access issues to examine the challenges for firms and consumers.

“Given our previous findings in this area, we see this as a critical time to fully explore these issues and consider potential solutions.”

The FCA is seeking input on:

- The challenges for firms in providing travel insurance for consumers who have, or have had, cancer.

- The challenges consumers face when they have, or have had, cancer in finding suitable travel insurance.

- Examples of innovative practices in the current market.

- Any barriers that firms face in addressing existing challenges or that prevent innovation.

- Potential improvements that could result in better consumer outcomes.

The FCA wants to understand how consumer outcomes can be improved in this area, including through innovation. The findings should read across to many other pre-existing medical conditions and insurance products.