Equifax is encouraging the short-term lending sector to speed up plans to share customer data.

The Competition and Markets Authority (CMA) last week published its report on payday lending including recommending the development of real-time data sharing to help new entrants better assess credit risks. The Financial Conduct Authority’s (FCA) November deadline for greater real-time data sharing is also fast approaching.

Craig Tebbutt, head of alternative lending at Equifax, said: “The FCA said in its July report that effective real-time data sharing with credit reference agencies is needed to address the issue of consumers running multiple short-term loans that they cannot afford from different lenders. Last week’s CMA report further endorsed the need for real-time data sharing.

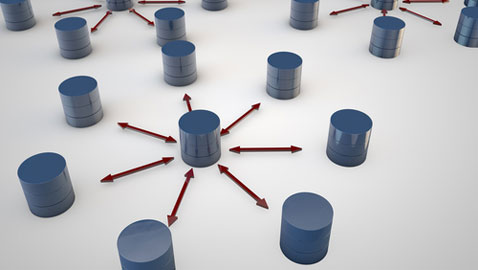

“We believe that the only real way to ensure that individuals do not get into a spiral of debt – using one loan to pay off another – is the real-time sharing of key information over the entire credit cycle. This includes account openings, account management and account closure.

“We also believe that real-time should mean exactly that – data should be shared by and made available to other lenders within 60-90 seconds of any key milestone in the credit lifecycle.”

Equifax’s recently launched Real-time Exchange has been developed in partnership with LendingMetrics, a short-term lending and real-time data specialist, to help the short-term credit sector meet the FCA’s requirements. It enables the sharing of data in real-time and Equifax claims it will provide greater predictive capability for short-term lending decisions, helping providers across the sector to extend credit more responsibly.