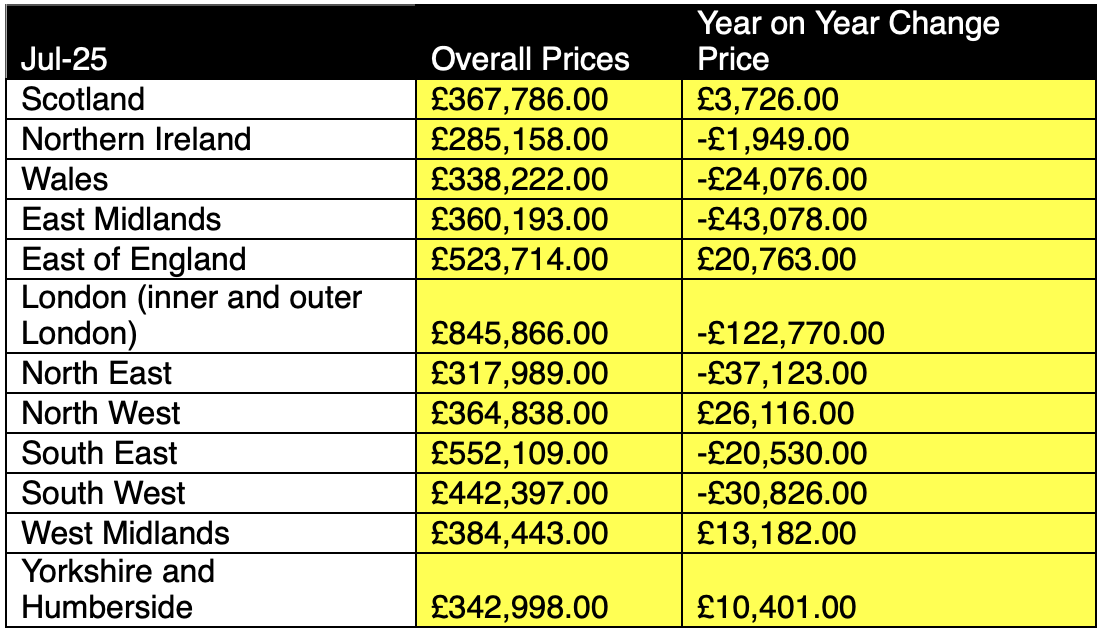

The average asking price of newbuild homes coming to market in the East Midlands has fallen by more than £43,000 in the past year reflecting wider signs that developers are adjusting pricing in response to softer demand and affordability pressures.

Between July 2024 and July 2025, new instructions in the region dropped by £43,078, according to analysis by Propertymark.

The North East recorded a decline of £37,123, while prices in the South West fell £30,826.

Across the UK, the average asking price for newbuild instructions now stands at £427,143.

PRICE REDUCTIONS

While newbuilds have traditionally commanded a premium, recent reductions suggest that developers are recalibrating expectations in order to sustain sales.

Not all regions saw declines. The East of England posted a £20,763 increase year on year, taking the average to £523,714, while the West Midlands rose £13,182 to £384,443.

The shifts come as ministers press ahead with plans to accelerate housing supply through the Planning and Infrastructure Bill, which aims to deliver 1.5 million new homes before the next election. Devolved administrations have also set their own ambitious housing targets.

POSITIVE OPPORTUNITY

Nathan Emerson, chief executive of Propertymark, said: “Any house price decreases often represent a positive opportunity for aspiring homeowners to progress with their ambitions regarding ownership.

“We have witnessed a noteworthy mix of price fluctuations regarding new build properties in various areas across the UK.”

SUBSTANTIAL CHALLENGES

But he added: “With many mortgage providers typically willing to lend around five times an annual income, there are still substantial challenges to overcome regarding potential affordability for many when looking at average prices regionally regarding new properties.

“Both the UK Government and the devolved administrations have clear cut challenges ahead of them to help ensure house prices are realistic.

“It remains vital that an enhanced flow of new homes reach the market in the areas where they are needed and the prospect of purchasing a home remains a practical ambition for those who aspire to own a home.”

Source: Propertymark