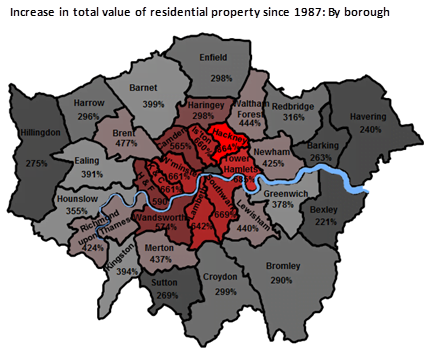

The total value of residential property in eastern boroughs of Central London has grown faster than any other area of the capital, according to new research from London estate agents Stirling Ackroyd.

Since the liberalisation of planning laws in 1987, the total value of homes in Hackney has risen by 864% – the fastest of any London borough. This is followed by Tower Hamlets and Southwark, with increases of 684% and 668% respectively, since the same year which also saw the opening of City Airport and the Docklands Light Railway.

Kensington & Chelsea has seen its residential property increase in value by ‘just’ 661% since 1987, meaning it comes in fourth place.

These gains compare with the whole of Greater London, with 453% growth in gross property value over the same period.

The value of all residential property in Greater London stands at £1.51 trillion, as of June 2014. This compares to just £273 billion in 1987. Moreover, Stirling Ackroyd forecast the value of London property is set to reach £2.01 trillion by mid-2017.

Andrew Bridges, managing director of Stirling Ackroyd, said: “Since the reforms and investment that started almost 30 years ago, London has rebuilt its place at the centre of the financial, cultural and technological worlds.

“At the time, the 1987 Town and Country Planning Order hardly seemed revolutionary – but this apparently dry document has proved profoundly effective. Hackney Council embraced the liberalisation of changes of use with particular gusto, at first through a desperate need for income, and later in a more organised way as the benefits became clear. And that is how Hackney – an unlikely candidate at the time – has led the London property market.

“Now, across London, the City of old has gone the way of the bowler hat – and our capital has developed a buzz from its under-loved corners. Just as a potent economic force is sweeping away old-fashioned views about particular boroughs, this is hand in hand with a more subtle, cultural shift. Londoners are increasingly looking forwards, turning their backs on the decline that dominated much of the twentieth century.”