Tenant demand across Great Britain has dropped sharply, marking a significant turning point in the rental market as more households make the leap to homeownership.

According to the latest data from Hamptons, the number of new tenants registering with lettings branches fell 17% year-on-year in May 2025, and now sits 28% below pre-pandemic levels recorded in 2019.

It is the twelfth consecutive month of annual declines in tenant registrations, signalling sustained softening across much of the sector.

With affordability slowly improving and buyer sentiment recovering, the data suggests the balance of power in the rental market is beginning to shift – and may stay that way, barring significant changes to interest rates or landlord legislation in the months ahead.

RISING RENTS

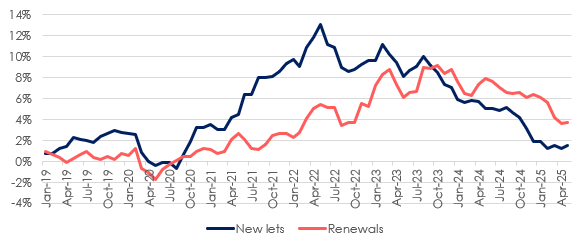

Rents are still rising, but at a far slower pace. The average rent on a newly let property increased just 1.5% over the 12 months to May – down from 5.1% a year earlier – bringing rental growth back in line with pre-Covid norms.

Source: Hamptons

The average monthly rent now stands at £1,366, with the most subdued conditions in London where rents on new lets fell 0.5% year-on-year.

Hamptons puts the cooling market down to a combination of softening demand and a gradual return of supply.

Stock levels rose 5% in May compared to a year earlier – the tenth consecutive month of growth – as properties took longer to let.

IMPROVING AFFORDABILITY

The shift in tenant behaviour appears driven by improving affordability in the sales market. For the first time in at least a decade, both London and Scotland have seen more first-time buyers register to purchase than tenants seeking to rent.

Nationally, there are now just 1.5 tenants registering for every prospective first-time buyer – down from 5.9 in 2017 – as falling mortgage rates make buying cheaper than renting for many with a 10% deposit or more.

CHANGING ARITHMETIC

Aneisha Beveridge, head of research at Hamptons, said: “This has boosted first-time buyer numbers and reduced demand in the rental sector.

“In a similar trend to the years following the last economic downturn, falling interest rates have reduced the pace of rental growth. Landlords rolling off short-term fixed-rate mortgages are now seeing their monthly payments fall, reducing the need to pass on further costs to tenants.

“At the same time, lower mortgage rates are changing the arithmetic for tenants who are thinking about buying. While rates remain high relative to pre-Covid times, three years of above-inflation rental growth mean that for most, buying remains cheaper than renting.”

RAPID RENTAL GROWTH

And she added: “It has taken the best part of two years for the pace of rental growth to fall from double digits down to 1.5%. This means that rents are now rising at a rate that’s close to their long-term average and suggests that the era of rapid rental growth is behind us for now.

“That said, rental growth is unlikely to cool much further. While falling interest rates should take the sting out of rental growth over the next few years, landlords will likely continue to price in political risk.

“Landlords are increasingly getting their heads around what the Renters’ Rights Bill will mean for them, but the way it plays out for landlords in reality will shape future investor appetite.”

HIGHER INCREASES

While rental growth on new tenancies has moderated, tenants renewing contracts continue to face higher increases. In May, renewal rents rose by 3.7% on average – more than double the rate of new lets – with the gap most pronounced in regions outside the capital. Tenants staying put now pay an average of £1,267 per month, saving around £99 compared to new renters entering the market.

Rents are still rising fastest in the Midlands and the North, led by cities with traditionally more affordable housing stock. By contrast, inner London saw a 1.6% fall in new let rents, pushing average prices back below June 2023 levels.