Large regional cities like Edinburgh, Birmingham and Manchester look set for a 20% to 30% increase in house prices over the next four years as they close the gap to London, according to the latest Hometrack UK Cities House Price Index.

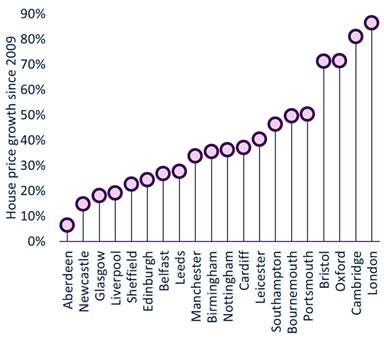

Since 2009, average house prices in London have risen by 86% in nominal terms (see graph). Oxford and Cambridge have also performed strongly, like extensions of the London market, followed by Bristol where prices have grown 70%. Yet in Aberdeen average house prices are just 6% higher over the same period and 18% higher in Newcastle. The wide variation in growth is down to local demand and economic factors, trends seen in previous housing cycles.

Graph: House price growth from 2009 to January 2018

Hometrack said that while regional cities have lagged the London market they are now starting to close the gap. Currently Edinburgh (7.7%), Birmingham (7.3%) and Manchester (6.7%) lead the way with above average year on year house price inflation. In contrast, the pace of growth in the capital has slowed to 1.6% year on year meaning house prices in London are falling in real terms. Overall UK city house price inflation is running at 5% up from 4% a year ago.

Cities outside southern England have further room for house price growth. Hometrack do not expect house prices to match the scale of growth registered in London since 2009 as the underlying market dynamics for London are different e.g. high levels of overseas and investor buying. There are also questions over the sustainability of pricing in London where gross yields are sub 4.5% and affordability levels are at an all-time high.

Hometrack expects average house prices in London to drift lower in real terms in the coming 2-3 years with lower turnover (down 16% since 2014) creating scarcity and supporting price levels.

Richard Donnell, insight director at Hometrack, said: “We expect to see average house prices rise by 20% to 30% in cities like Edinburgh, Birmingham and Manchester in the next three to four years. The income to buy a home in regional cities is well below the London average so in the near term we expect to see rising house prices stimulating additional buying and market activity in those areas.

“House prices have some way to increase before there is a material constraint on demand. This assumes mortgage rates remain low by historic standards and the economy to continues to grow.”