CIExpert has added Guardian to its Children’s Critical Illness (CI) Protection Customiser Tool and complimenting existing options from Vitality and Zurich.

Advisers no have access to the full suite of insurers offering tailored children’s CI benefits, helping them adapt cover more easily to match client needs with greater speed and simplicity.

CIExpert’s enhanced quotation services are specifically designed to allow parents to choose the level of children’s cover they need or can afford, while also supporting advisers in meeting compliance and Consumer Duty requirements.

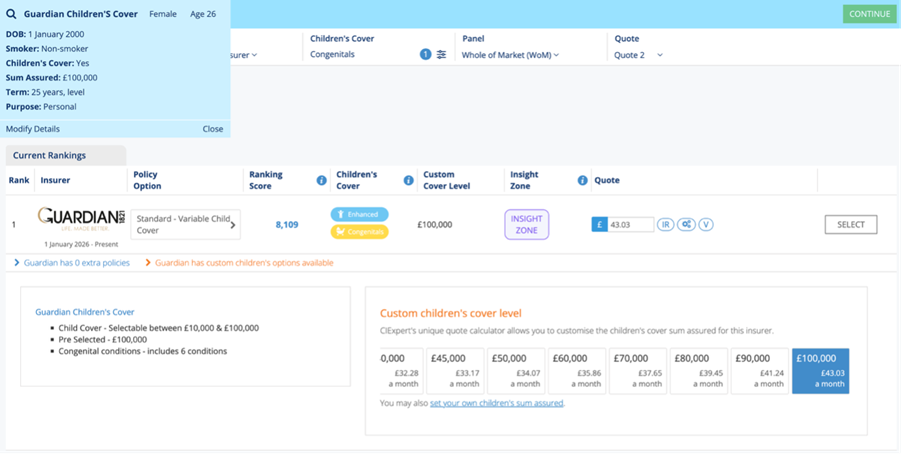

With CIExpert’s cost-versus-quality analysis, advisers can now recommend Guardian’s cover in any amount between £10,000 and £100,000*, providing flexibility for both clients and their children’s protection needs.

Available to all CIExpert subscribers at no additional cost, the customisation features are fully integrated via CIExpert’s portal links with Iress Exchange, Xplan for Mortgages, iPipeline’s SolutionBuilder, UnderwriteMe’s Protection Platform and Synaptic, streamlining access across the advice journey.

EVOLVING PERSPECTIVE

Alan Lakey, Director at CIExpert said: “The role of children’s critical illness cover has evolved significantly. It is no longer just a scaled-down version of adult cover.

“Today’s policies reflect a much wider range of family needs, including birth-related and congenital conditions, and they often extend cover through to early adulthood, right up to university age.

“Our Critical Thinking 2024 research highlighted that many parents now see children’s CI not just as a financial lifeline for time off work, but also as a way to fund childcare or treatment in situations where NHS support may be limited.

“This evolving perspective reinforces the importance of offering flexible levels of cover that can be tailored to real-life needs.”

NO LONGER NICHE

And he added: “In 2025, children’s cover was included in 85% of all comparisons on our platform. That tells us this is no longer a niche consideration. It is becoming central to high-quality, family-focused protection advice.

“Our customisation tools are designed to help advisers strike the right balance between cost and quality, and to do so with confidence. That is what this latest addition with Guardian enables.”

CENTRAL TO ADVICE

Hilary Banks, chief commercial officer at Guardian, said: “The research we sponsored with Young Lives vs Cancer in September 2023 found that around 4,000 children and young people in the UK are diagnosed with cancer each year, and families face almost £700 a month in extra costs for essentials like travel for treatment, parking, food and clothing.

“It highlights why children’s critical illness cover should be a central part of financial advice, and why giving families the flexibility to tailor their cover really matters.

“The Customiser really highlights the value of children’s critical illness cover.”

“I’m pleased we’re part of CIExpert’s Children’s Critical Illness Customiser, alongside providers who share our flexible approach.

“By allowing advisers to model different levels of children’s cover, the Customiser really highlights the value of children’s critical illness cover – showing exactly how tailored support can help families facing unexpected financial strain.

“It gives advisers another way to deliver the right recommendations and helps push the industry forward, and as a challenger, we champion that. Anything that encourages more advisers to have proactive conversations about protection and the support it can offer has our full backing.”