The Financial Intermediary & Broker Association (FIBA) has announced that CHL Mortgages for Intermediaries has been added to its lender panel.

The specialist buy-to-let lender, part of the Chetwood Bank group, operates exclusively through brokers and provides funding across England and Wales.

Its range includes loans for HMOs, multi-unit freehold blocks, short-term lets such as serviced accommodation, and standard rental properties.

Martin Reynolds, chair of FIBA, said the addition strengthened the association’s offering at a time when landlords are increasingly diversifying into higher-yielding assets.

“Over the past few years, we’ve seen some seismic shifts in the specialist lending market, including a growing number of clients transitioning their portfolios away from traditional buy-to-lets towards HMOs and semi-commercial property that offer higher yields,” he said.

“With an approach which allows it to assess cases other lenders often cannot, including large HMOs with up to 10 bedrooms, MUFBs with up to 10 self-contained units, and complex HMO and MUFB layouts, CHL Mortgages for Intermediaries certainly offers something different, and I’m delighted to welcome them to the FIBA panel.”

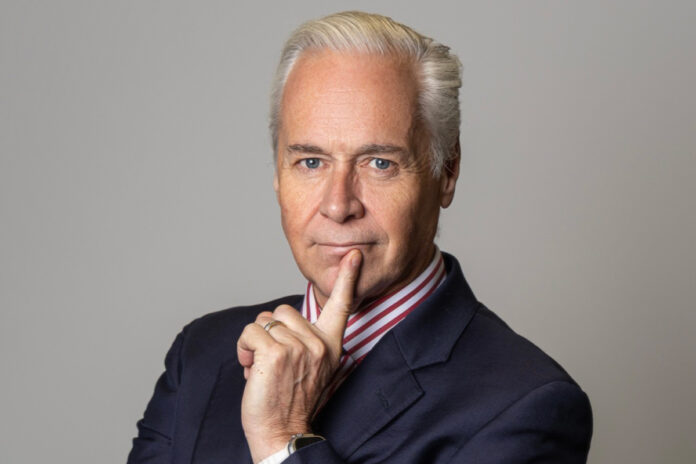

Roger Morris (main picture), group distribution director at CHL Mortgages for Intermediaries, described the appointment as an important step in the lender’s engagement with brokers.

“We’re delighted to have been added to the panel of such a prestigious organisation as FIBA. FIBA members consistently demonstrate technical expertise that stands head and shoulders above the competition.

“The opportunity to engage with such highly skilled professionals in the world of complex buy-to-let is a genuine privilege for us.”

He added that CHL was looking forward to working with FIBA’s members to support brokers and their landlord clients in a changing buy-to-let market.