Children are exerting unprecedented sway over property choices with 74% of families saying their offspring have a say in final housing decisions, according to new research from Zoopla.

The influence is strongest among younger generations: 40% of Gen Z movers say their children are either the primary decision-makers or play a significant role in the final choice, compared with 32% of Millennials.

The findings echo a broader trend in which children are shaping major household purchases, from smartphones to cars.

Regionally, the highest levels of child influence are in Scotland (37%) and Eastern England (33%). The South East (26%), Yorkshire and the Humber (27%), and both the South West and West Midlands (28%) report the lowest.

The West Midlands also tops the list for households where children have “no influence whatsoever” (35%), followed by the South West (32%).

When it comes to compromise, children rarely yield ground, accounting for just 1% of concessions in the home-buying process, compared with 56% for adults.

HOME MOVE CEO

While children’s influence is rising, decision-making roles between adults remain sharply defined.

Men lead the overall process in 32% of moves, compared with 25% for women, particularly in financial and logistical areas.

Source: Zoopla

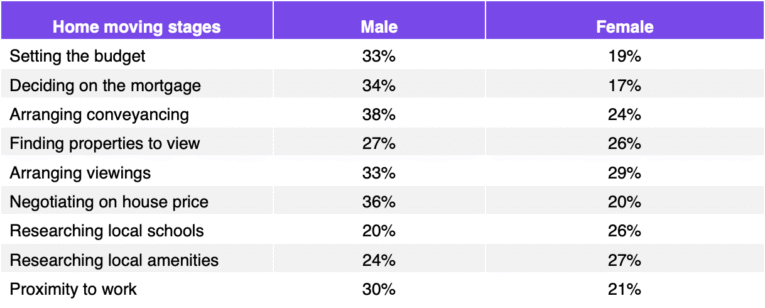

Men are more likely to set the budget (33% vs 19%), decide on the mortgage (34% vs 17%), arrange conveyancing (38% vs 24%) and lead price negotiations (36% vs 20%).

Men also have greater confidence in assessing a property’s value (42% vs 25%). Women, however, are more likely to reject a property (57% vs 43%) and less likely to concede on “must-haves” – 25% versus 31% of men.

GENERATIONAL DIVIDE

In 39% of households, the decision to move is initiated by one person alone, with both partners making the decision together in 35% of cases. Only 25% share the research into properties and market trends equally.

Baby Boomers are the most collaborative: 60% make the decision to move jointly, compared with 25% of Gen Z and 31% of Millennials. They are also most likely to share property research duties (31%).

FAMILY HOME, FAMILY DECISION

Daniel Copley, Consumer Expert at Zoopla, said: “It’s clear that collaborative decision-making is on the rise, especially among Millennials who are truly leading the charge in teamwork.

“However, the most compelling finding is undoubtedly the growing influence of children. For a significant portion of the market, the family home is truly a family decision.”