Cardiff’s CF24 postcode has overtaken rivals to become the most active buy-to-let location in the UK, according to new figures released by Paragon Bank.

The lender’s analysis of buy-to-let mortgage activity in the 12 months to the end of June 2025 shows that CF24, which spans areas east of the city centre and includes the Royal Infirmary, attracted more landlord investment than any other postcode across England and Wales. It marks a significant jump for the Welsh capital, climbing from fifth place in the previous year’s ranking to the top of the list.

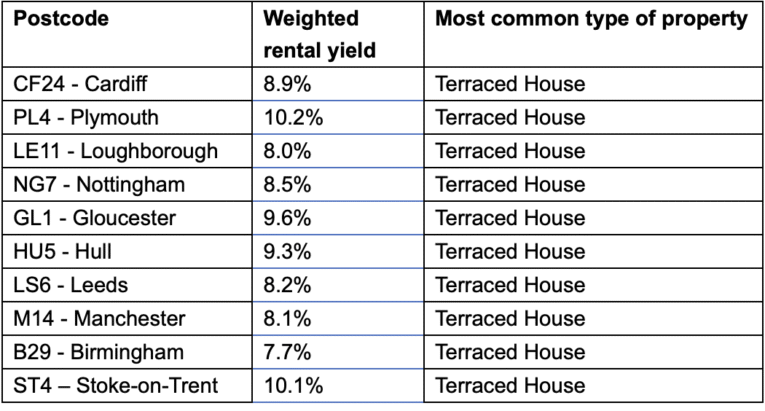

More than 42% of homes in CF24 are privately rented, with average yields of 8.9%. The area’s popularity is driven by demand from students and NHS workers, with Cardiff University, Cardiff Metropolitan University and the University of South Wales all within close proximity. The University Hospital of Wales and St David’s Hospital sit just outside the boundary, while the Royal Infirmary is located within it.

Over a quarter of CF24’s population are students, underlining its appeal for landlords targeting the education sector.

PLYMOUTH

Plymouth’s PL4 postcode has entered the rankings for the first time, taking second place. The area boasts the highest rental yields of all ten hotspots at 10.2%. Like Cardiff, it benefits from a strong university presence – including the University of Plymouth, Arts University Plymouth and Plymouth Marjon University – and access to key worker tenants employed at Mount Gould Hospital.

With an average property price of £216,000, significantly below the national average of £286,000, PL4 offers an attractive entry point for investors seeking high returns.

LOUGHBOROUGH

Loughborough’s LE11 postcode placed third, up from eighth last year. The area is home to Loughborough University, widely regarded as one of the UK’s leading institutions, as well as Loughborough Hospital. Properties here achieved average annual yields of 8.0% over the period.

Nottingham’s NG7, which includes parts of the city’s inner suburbs, retained fourth position, while Gloucester’s GL1 entered the top five with yields of 9.6%. Other returning hotspots included HU5 in Hull (9.3%), LS6 in Leeds (8.2%), and Birmingham’s B29 (7.7%).

Manchester’s M14 postcode, which topped the list in 2024, dropped to eighth place this year with average yields of 8.1%. Stoke-on-Trent’s ST4 rounded out the top 10, recording yields of 10.1%.

Terraced houses were the most commonly purchased property type in all ten hotspots. According to Paragon, their relative affordability and flexibility make them particularly attractive to landlords, whether configured as single lets or converted into HMOs.

Louisa Sedgwick, managing director at Paragon Bank, said: “Looking at our lending data covering the 12 months to the end of June, we can see similarities in landlord investment strategies.

“Our data also shows that landlords typically purchase properties in larger towns or cities and within relatively close proximity to universities or large local employers, benefitting from strong and stable demand.

“This support of higher education and healthcare, in addition to important sectors such as software, manufacturing and logistics, highlights the often-overlooked contribution of the PRS to the UK economy.”

She added that terraced housing remains the backbone of landlord portfolios. “Smaller terraces are often more affordable than other property types, making them a good place to start for newer landlords or those looking to expand their portfolios.

“At the other end of the scale, HMOs are often classified as terraced properties but benefit from typically higher yields owing to the capacity for multiple tenancies,” Sedgwick said.

Source: Paragon