Landbay’s latest Rental Index has revealed that rents in London increased by 0.10% in the 12 months to June 2018, the first annual rental increase for the capital in 18 months.

Rents in London have fallen on a year-on-year basis every month since December 2016; however rental growth in the capital finally returned to positive territory in June. The average rent paid for a property in London now stands at £1,884, still 2.5 times the rest of the UK (£764) despite the tough London market in recent years pushing rents down.

Elsewhere in the UK, rental growth continues to slow. This has been a similar picture throughout H1 of 2018, with UK rents rising by just 0.40% in the first six months of the year, or 0.54% if you exclude the capital. The East Midlands and East of England have been the strongest regions for rental growth so far this year, rising by 0.95% and 0.70% respectively, while the North East has dragged behind with rents falling by -0.08% in the first half of the year.

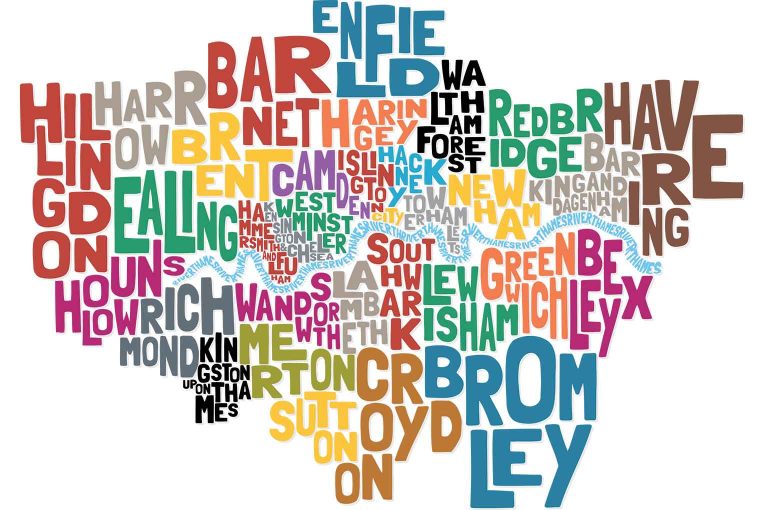

At a county level, Nottingham (1.43%) and Northamptonshire (1.25%) saw the fastest rental increases in H1. Meanwhile, at a London borough level, rents have risen in 25 of the 33 boroughs over the course of the last six months. Just Barking and Dagenham (-0.02%), Barnet (-0.29%), Brent (-0.65%), Hammersmith and Fulham (-0.07%), Kensington and Chelsea (-0.34%), Kingston Upon Thames (-0.05%), Tower Hamlets (-0.01%) and Waltham Forest (-0.21%) have seen rents fall since the start of the year.

John Goodall, CEO and co-founder of Landbay, said: “While there remains a huge degree of regional variation, the overall trend has been a slowing of rents across the UK in the first half of this year. However, much of this has been London weighing down heavily on otherwise resilient growth across the UK. Now that London rents have bounced back to growth this could all be about to change.

“Wherever they’re based, landlords have had to face a myriad of challenges over the past two years, with regulatory and tax changes reshaping the sector. Despite this, there has been little sign of them passing on additional costs to tenants. However, with a rate rise on the horizon, meaning a rise in the cost of borrowing for landlords, we may well start to see landlords increasing rents in the coming months to stay afloat.”