Buy-to-let investment is showing signs of renewed momentum as landlords respond to easing pressure in the rental market and signs of stabilising returns, according to new data from Rightmove and UK Finance.

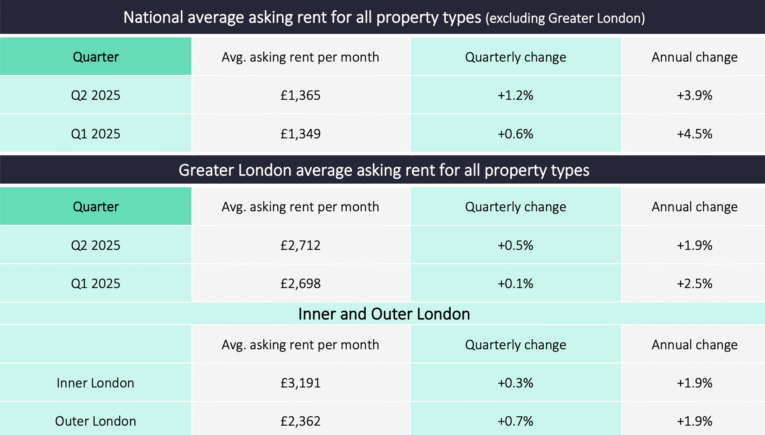

The average advertised rent for newly listed properties outside London reached a fresh high of £1,365 per calendar month (pcm) in the second quarter, up 1.2% on the previous quarter. In the capital, average rents rose 0.5% to £2,712 pcm, marking a 15th consecutive record.

However, annual rent growth outside London has slowed to 3.9%, the lowest rate since 2020.

This signals a continuing cool-down following the frenetic post-pandemic period when demand spiked and rents surged by over 44% since 2020 – outpacing earnings growth of 36% over the same period.

SUPPLY AND DEMAND REBALANCE

The pace of rent increases has eased as supply and demand in the rental sector begins to rebalance. Available rental stock is up 15% year-on-year – led by a 33% increase in the North East – while tenant demand has fallen by 10% over the same period.

As a result, the average number of enquiries per listing has fallen to 11, down from 16 last year.

Landlords appear to be responding. According to UK Finance, the number of buy-to-let loans issued so far this year is up 17% compared to the same period in 2024.

Within that, new buy-to-let home purchases are up 28%, suggesting that confidence in the sector may be returning after years of regulatory pressure and rising costs.

This renewed investment is welcomed by the market as a way to boost rental stock and help ease further upward pressure on rents.

BUY-TO-LET INVESTMENT

Colleen Babcock, property expert at Rightmove, said: “Despite another new record in average asking rents for tenants, the big picture is that yearly rent increases continue to slow, which is good news for tenants.

“Supply and demand is slowly rebalancing towards more normal levels, though we still have a way to go before we reach pre-2020 levels of available homes for tenants.

“The good news is that the latest industry snapshot suggests more investors are taking out buy-to-let loans compared with last year, which should help to bring even more homes to the rental market.”

SATBLE MARKET AHEAD

Letting activity has also slowed, with the average time to secure a tenant rising to 25 days, up from 21 last year. Nearly a quarter (24%) of rental homes are now seeing a reduction in asking price during marketing – the highest proportion since 2017.

Although rental yields remain under pressure in some regions due to high borrowing costs, improved tenant choice, a slower pace of rent growth, and a tentative recovery in landlord lending suggest a more stable period may be emerging for the buy-to-let market.