British Money recently announced its intention to release £50 million to help get people on the housing ladder. Now, director Simon Burgess has announced the money will now be offered to graduates in the form of deposit loans under its wholly-owned subsidiary company, British Loans Limited.

His support for graduates comes after it was found lenders consider student loans a committed expenditure and so are likely to offer them a lower mortgage – if at all. Those however, with a 5% deposit improve their chances of securing funds.

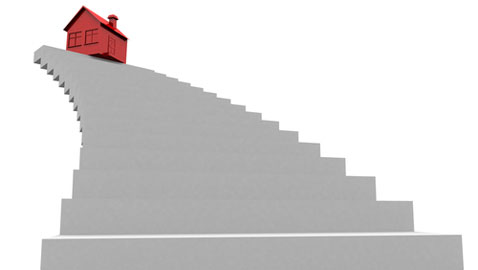

Burgess said: “I’m keen to give graduates a ‘leg-up’ onto the housing ladder by providing them with their deposit. It’s near impossible to scrape together £11,000+ – which is five per cent of the average house price* in the south east – if you’re having to pay rent and other household costs.

“Deposit loan and mortgage repayments combined will be substantially less than the cost of renting – giving this ‘penalised generation’ the opportunity to invest in an appreciating asset. Lenders are denying housing to a whole generation of people through no fault of their own, so it’s time to bring ethics back into lending.“

The firm claims borrowers will be offered a “competitive” APR and free Defaqto-rated five star income protection and Burgess confirms if affordability is an issue, he will accept parents as guarantors.