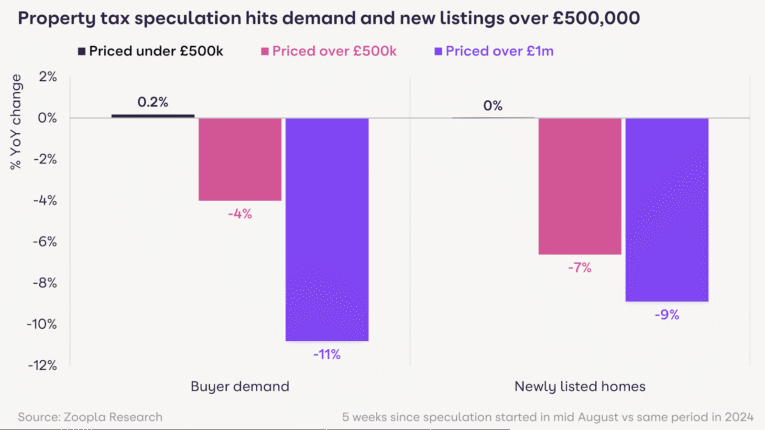

The UK housing market is showing signs of strain at the top end as speculation over possible tax changes in the November Budget prompts buyers and sellers of higher-value homes to step back.

According to Zoopla’s latest House Price Index, demand for properties priced over £500,000 has fallen by 4% over the past year, while new listings in the same bracket are down 7%.

The slowdown is even sharper in the £1 million-plus market, where demand is down 11% and new supply has dropped by 9%.

With one in three homes currently for sale priced above £500,000 and 8% of stock over £1 million, the impact is most pronounced in London and the South East, where stamp duty costs and affordability constraints are already dampening activity.

SLOWING HOUSE PRICE GROWTH

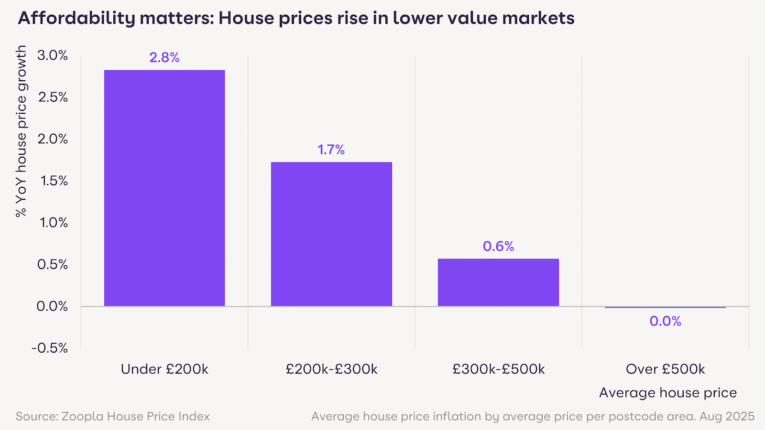

At the same time, house price growth has been slowing nationally. Annual growth has slipped from 1.9% in December 2024 to 1.4% in August, with the average UK home now valued at £271,000 – up just £4,350 over the past year.

By contrast, cheaper markets remain buoyant. Prices are rising fastest in areas where the average home costs under £200,000, up 2.8%, with Northern Ireland leading growth at 7.9% and the North West recording 3.1%.

Local markets in Kirkcaldy, Oldham, Tweeddale, Motherwell and Llandrindod Wells are all registering annual increases above 4%.

Southern England tells a different story, with annual price falls of 1% across second-home hotspots such as Bournemouth, Truro, Exeter and Torquay, as well as parts of central London. More aggressive council tax measures for second homeowners are driving stock onto the market, weighing on prices.

MOST SALES SINCE 2022

Richard Donnell, executive director at Zoopla, said: “The housing market has experienced a sustained increase in market activity over the last 18 months as mortgage rates have stabilised. The market is on track for the most sales since 2022, but without rapid house price inflation.

“Pre-Budget speculation over possible tax change is a regular occurrence but this summer it has been bigger than usual which has led some buyers and sellers to delay home moving decisions for homes priced over £500,000. The wider market remains largely unaffected.

“Serious buyers should think twice before delaying as while the Budget is two months away it takes, on average, six to seven months to find a property and complete a sale.”

BUYERS MARKET

Kevin Shaw, national sales managing director at LRG, the UK’s largest estate agency group, added: “The housing market has shifted in favour of buyers, with sellers increasingly willing to align with agents’ valuations and to negotiate on price.

“That balance is welcome for many purchasers, particularly first-time buyers who appear undeterred by April’s increase in Stamp Duty and have benefitted from lower interest rates.”