Buy-to-let lenders have begun reassessing their approach to energy-inefficient properties in anticipation of looming net zero regulations, according to new research by property data firm Cotality.

The study, Temperature Check 2025: How prepared are buy-to-let lenders for future property risk?, reveals that several lenders are actively exploring how new environmental standards could affect their future lending strategies.

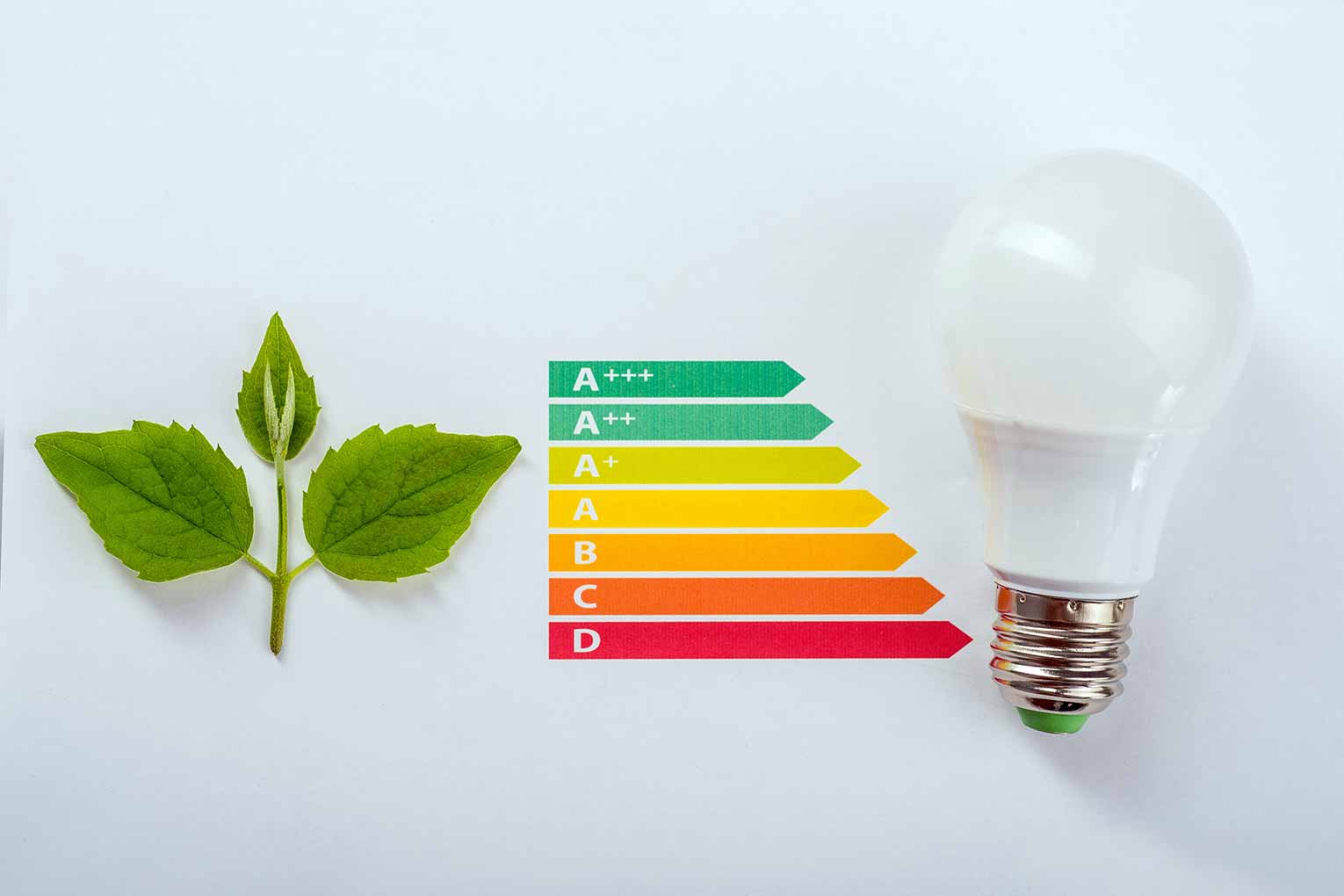

It comes ahead of planned legislation that will require all newly rented properties to have an energy performance certificate (EPC) rating of at least band C by 2028, with all private rented homes to follow by 2030.

IMPLICATIONS

The implications of these deadlines are already being felt. A landlord seeking a five-year fixed rate mortgage on a property rated below band C could fall foul of the regulations before the mortgage term ends, if a new tenancy begins after the 2028 deadline. That possibility is prompting lenders to scrutinise how such loans could expose them to future regulatory risk.

Cotality’s research, based on interviews with credit and risk executives at a range of specialist buy-to-let lenders, banks and building societies, found that some lenders are taking early steps to manage what is now being described as “net zero risk”. These measures include the potential tightening of lending criteria and a growing interest in using more dynamic data sources to assess environmental performance at the property level.

Among the emerging data sources being considered are smart meter readings, half-hourly electricity usage profiles, flooding and weather risk data from the Environment Agency and Met Office, satellite and aerial imagery, and local authority records of property retrofits and improvements. The government’s own EPC database is also expected to play a critical role in shaping future lending decisions.

NOT ALL PREPARED

Despite these developments, not all lenders appear to be equally prepared. The report found that some institutions have yet to determine how the regulations will impact their risk appetite. Many also cited “patchy” access to the kind of granular data needed to assess energy performance accurately and consistently.

These data shortfalls were discussed at a closed event to launch the report, where lenders and valuation firms warned that growing awareness of the regulations could soon lead to fierce competition for mortgages on homes already rated EPC band A, B or C. That, in turn, may further marginalise landlords with properties that fall short of the required energy standards.

Mark Blackwell, chief operating officer at Cotality UK, said there was a clear desire among lenders to address the issue. “There’s an imminent regulatory deadline that requires them to do it, but during our research we found that without more robust data inputs and better access to model scenarios, many aren’t as far on as they want to be,” he said.

“There are ways to address this and our research highlighted that lenders are taking a wide range of approaches. What was common to all though, is that meeting the challenge of net zero is not straightforward, and it will require the co-operation of all parts of the market to achieve it in such a short time.”