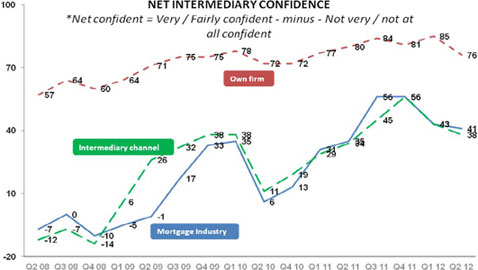

Mortgage intermediaries have become more confident about the overall outlook for the mortgage market in the first half of 2012, according to research from Halifax Intermediaries.

There was a rise in the proportion reporting an increase in confidence compared to the same period in 2011.

BDRC Continental research conducted for Halifax Intermediaries questioned 300 brokers on the overall mortgage industry, the intermediary sector and their own business. 70% of brokers were encouraged by the more competitive rates being offered through the second quarter of the year, leading to an increase in the average number of cases being written per individual broker in the preceding 12 months, to 74.5 – up from 62 in the first half of 2011 and 66.5 in the second half of last year.

UK mortgage approvals have increased by 12% over the same period. However, in terms of the type of business being conducted, brokers are reporting the greatest increases in cases coming from specialist buy-to-let lending and also remortgage activity which has increased by 3% over the first half of the year compared to H1 2011.

“Mortgage brokers are a resilient bunch and it is encouraging to see increasing confidence in the sector over the course of the last few years – albeit slowly,” said Ian Wilson, head of Halifax Intermediaries.

“However, the economic outlook remains challenging and the mortgage market is still limited, with brokers concerned that whilst an increasing number of products are available, distribution remains restricted.

“In recent weeks, however, confidence has dipped marginally compared to the highs reported in the second half of 2011, as brokers report tightening of lending criteria as a key detractor of confidence.”

The research also found that 7.5% more brokers were more confident in the the intermediary sector than in the first half of 2011. Many said increasing lending volumes and less competition in the broker channels as many smaller IFAs and ARs leave the industry as a result of incoming regulatory changes as the main drivers of the increase in overall confidence in the intermediary sector.

Meanwhile, brokers remain the most confident in the performance of their own business/firm, which has seen a marginal increase in confidence of 1%.