BEP Systems has designed what has dubbed an ‘agile underwriting system for lenders.

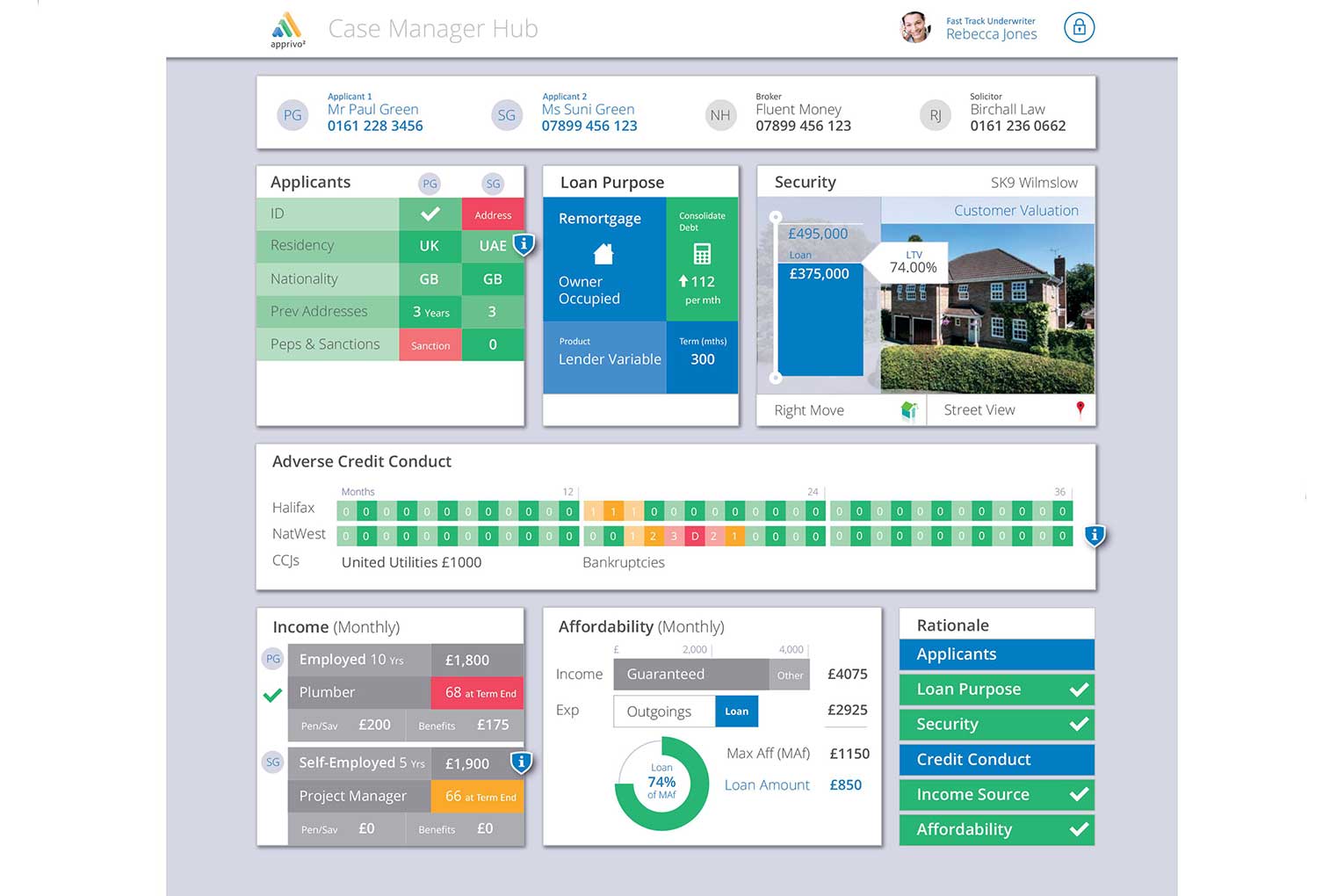

The concept is to bring the whole loan process into one holistic system, instead of trying to operate across multiple systems. Now case managers and underwriters can make decisions from one interface, including a visual representation of the risk which BEP Systems believes can “considerably” shorten the underwriting process.

Developed as a module for BEP’s Apprivo2 system, Agile Underwriting integrates underwriting, case management and funding teams.

Underwriters will be able to use Agile Underwriting to reprioritise, using shortcuts and wizards which will enable them to react to any changes to a case and change their priorities accordingly.

Apprivo2 also highlights risk through its Risk Assessment Hub. This makes underwriting a loan a visual process, enabling the underwriter to visually build up the rationale to lend.

Chris Little, managing director of BEP Systems, said: “Apprivo2 Agile Underwiting is a revolutionary system which will both simplify and speed up the process of underwriting. It works across mortgages, secured and unsecured loans, visualising risks and enabling underwriters to easily reprioritise.

“This will transform the process for underwriters providing a real competitive edge for the lenders who use this system.”