Bank of Ireland UK is temporarily withdrawing all new business mortgage and further advance products above 85% loan to value (LTV) due to current constraints as a result of the COVID-19 situation.

This will also affect above 85% LTV products provided by Bank of Ireland UK through its partnership with the Post Office.

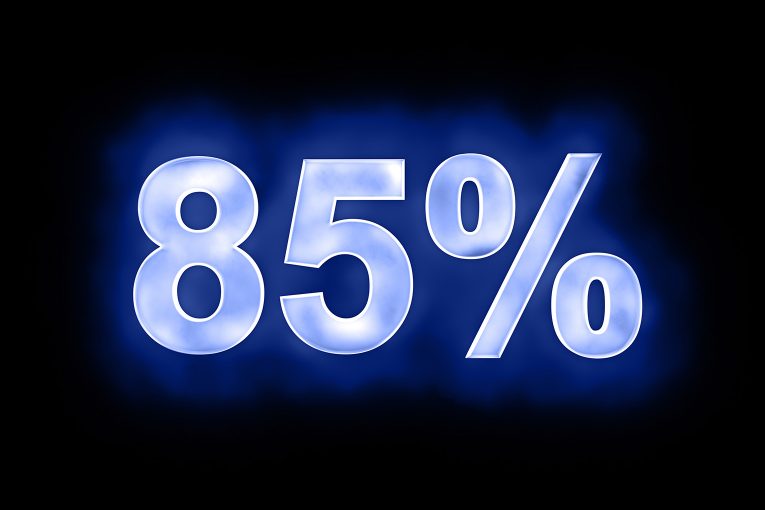

It will continue to lend up to a maximum of 85% LTV across all new mortgages (residential and buy-to-let) and further advances.

It is also focused on providing support to existing customers, especially those who require payment breaks and mortgage offer extensions.

Pipeline cases and product transfers are unaffected by this change, and will continue to be processed as normal.

Ian McLaughlin, CEO, Bank of Ireland UK, said: “Bank of Ireland is committed to supporting customers through the COVID-19 pandemic. We have a range of supports in place, including mortgage payment breaks of up to three months across residential and buy-to-let mortgages.

“The safety and welfare of our colleagues and customers and the continuity of our services remains our priority. Our team will be contacting intermediaries to explain the current situation and to understand how they can support their customers.”